You can get Uniswap v3 prices using the Uniswap API or The Graph’s subgraphs for real-time data.

Understanding Uniswap v3 Pricing

What is Uniswap v3?

Uniswap v3 is the latest version of the popular decentralized exchange (DEX) Uniswap, which operates on the Ethereum blockchain. It introduces several advanced features aimed at improving the efficiency, flexibility, and overall user experience of the platform.

- Concentrated Liquidity:

- Liquidity providers can now concentrate their capital within specific price ranges, resulting in more efficient use of their funds.

- This allows for greater liquidity depth at chosen price points, enhancing trading efficiency and reducing slippage.

- Multiple Fee Tiers:

- Uniswap v3 offers multiple fee tiers (0.05%, 0.3%, and 1%) to cater to different risk profiles and market conditions.

- This enables liquidity providers to choose a fee tier that best matches their investment strategy and the volatility of the token pair.

- Improved Oracle Services:

- The v3 update enhances the time-weighted average price (TWAP) oracles, providing more reliable and accurate on-chain price data.

- This is crucial for DeFi applications that rely on precise price feeds for smart contract operations.

- Non-Fungible Liquidity:

- Unlike v2, where liquidity was represented by fungible ERC-20 tokens, v3 introduces non-fungible token (NFT) positions.

- Each liquidity position is unique and represented as an NFT, reflecting the specific price range and amount of liquidity provided.

How Does Uniswap v3 Pricing Work?

Uniswap v3 utilizes an automated market maker (AMM) model to determine token prices. The pricing mechanism is based on the constant product formula and is influenced by the liquidity and trading activity within the pool.

- Constant Product Formula:

- The formula 𝑥⋅𝑦=𝑘 remains central to Uniswap’s pricing mechanism, where 𝑥 and 𝑦 represent the reserves of two tokens in a liquidity pool, and 𝑘 is a constant.

- This formula ensures that the product of the two reserves remains constant, dynamically adjusting prices based on supply and demand.

- Price Ranges:

- Liquidity providers can allocate liquidity within specific price ranges, allowing for more targeted liquidity provision.

- Prices are influenced by the concentration of liquidity within these ranges. Higher liquidity within a narrow range can lead to tighter spreads and more stable prices.

- Arbitrage and Market Efficiency:

- Arbitrageurs play a critical role in maintaining price accuracy on Uniswap by exploiting price discrepancies between Uniswap and other exchanges.

- Their activities help align Uniswap’s prices with the broader market, ensuring efficient and fair pricing.

- Fee Impact on Prices:

- The chosen fee tier affects the overall cost of trading on Uniswap v3. Higher fees can discourage small trades but may attract larger liquidity providers seeking higher returns.

- The fee structure also impacts the net prices received by traders, as fees are deducted from the traded amounts.

Using the Uniswap Interface

Accessing Uniswap v3

To access Uniswap v3 and start using its features, follow these steps:

- Visit the Official Website:

- Navigate to Uniswap: Open your web browser and go to the official Uniswap website at https://app.uniswap.org.

- Secure Connection: Ensure you are on the correct website by checking the URL and looking for the secure connection padlock symbol.

- Connect Your Wallet:

- Click on “Connect Wallet”: In the top right corner of the Uniswap interface, click the “Connect Wallet” button.

- Choose Your Wallet: Select your wallet provider from the list (e.g., MetaMask, Trust Wallet, Coinbase Wallet). Follow the prompts to authorize the connection.

- Authorize Access: Confirm the connection in your wallet app. This may involve approving access and signing a message to verify ownership.

- Switch to Uniswap v3:

- Select the Version: Ensure you are using Uniswap v3 by checking the interface. If needed, you can switch between v2 and v3 through the platform’s settings or version toggle options.

Finding Token Prices on Uniswap

Finding token prices on Uniswap is straightforward once your wallet is connected. Here’s how to do it:

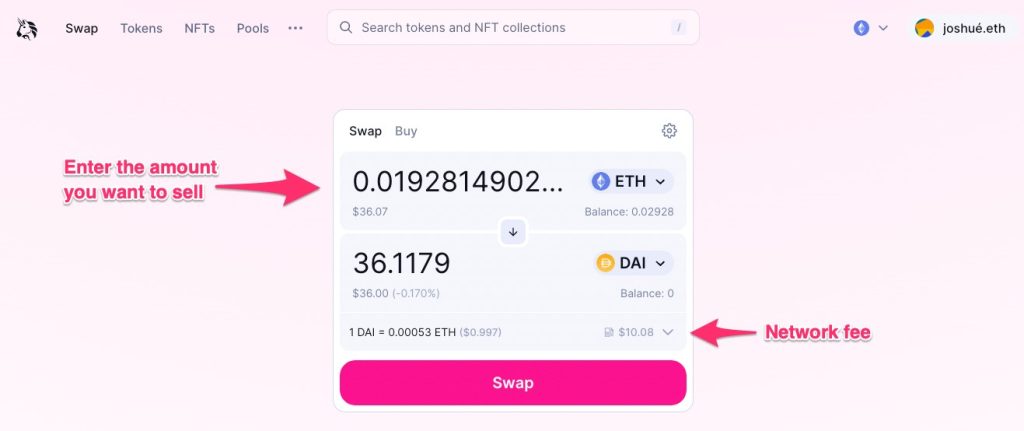

- Use the Swap Interface:

- Navigate to the Swap Section: From the main Uniswap interface, select the “Swap” option to access the trading section.

- Select Tokens: Click on the token dropdown menus to select the tokens you wish to swap. For example, choose ETH in the first field and the desired token (e.g., DAI) in the second field.

- Enter Amount: Enter the amount of the token you wish to swap. The interface will automatically display the estimated amount of the other token you will receive, along with the current exchange rate.

- View Price and Details:

- Check Price Impact: Uniswap will show the price impact of your trade, which indicates how much your transaction will move the market price.

- Review Fees and Slippage: The interface provides details on the liquidity provider fee and slippage tolerance settings, which you can adjust according to your preferences.

- Confirm Swap: To finalize the trade, click “Swap” and confirm the transaction in your connected wallet.

- Explore Pool Information:

- Go to the Pool Section: Select the “Pool” tab to view details about liquidity pools.

- Select a Pool: Choose a liquidity pool to see its statistics, including the total liquidity, volume, and price range. This can give you insights into the market dynamics for specific token pairs.

- Use Price Charts:

- Third-Party Tools: For more detailed price analysis, you can use third-party tools and integrations. Platforms like DeFi Pulse, CoinGecko, and Dune Analytics provide comprehensive price charts and historical data for Uniswap tokens.

- On-Chain Data: Utilize blockchain explorers like Etherscan to track real-time and historical price data directly from the blockchain.

Using Blockchain Explorers

Utilizing Etherscan for Prices

Etherscan is a popular blockchain explorer that provides detailed information on Ethereum transactions, including token prices:

- Access Etherscan:

- Visit the Website: Go to Etherscan.

- Search for Token: Use the search bar to enter the name or contract address of the token you want to check. For example, enter “Uniswap” or the specific token contract address.

- View Token Information:

- Token Overview: Once you find the token, click on it to view its detailed information page.

- Price Data: The token’s page will display current price, market capitalization, and price charts. This data is updated in real-time.

- Transaction History: Review recent transactions involving the token, which can give you an idea of current trading activity and prices.

- Additional Features:

- Token Holders: Check the distribution of token holders to understand the liquidity and potential market influence.

- Analytics: Use the analytics tab for more in-depth data, including price trends, trading volume, and historical performance.

Finding Prices with Blockchair

Blockchair is another blockchain explorer that provides comprehensive data across multiple blockchains, including Ethereum:

- Access Blockchair:

- Visit the Website: Navigate to Blockchair.

- Select Ethereum: From the main menu, choose Ethereum to focus on Ethereum blockchain data.

- Search for Token:

- Enter Token Details: Use the search function to find the specific token by name or contract address. For example, you can search for “Uniswap” or the token’s contract address.

- Analyze Token Data:

- Price Information: Blockchair provides current price data along with historical price charts. This allows you to track price movements over time.

- Transaction Details: Review detailed transaction data for insights into recent trades and price changes.

- Market Data: Access additional market data, including total supply, trading volume, and liquidity.

- Using Filters and Tools:

- Advanced Filters: Utilize Blockchair’s advanced filters to customize your search and focus on specific data points, such as high-value transactions or specific timeframes.

- Export Data: For deeper analysis, you can export transaction data and price information to analyze offline.

Using DeFi Analytics Tools

Tracking Prices with DeFi Pulse

DeFi Pulse is a leading analytics platform that provides comprehensive data on decentralized finance (DeFi) projects, including Uniswap:

- Access DeFi Pulse:

- Visit the Website: Go to DeFi Pulse.

- Navigate to Uniswap: Find Uniswap in the list of DeFi projects or use the search bar to locate it directly.

- View Uniswap Data:

- Total Value Locked (TVL): DeFi Pulse displays the total value locked in Uniswap, which indicates the overall liquidity available in the protocol.

- Price Information: Although DeFi Pulse primarily focuses on TVL, it often includes links or references to price information and related analytics.

- Using Price Widgets:

- DeFi Pulse Index (DPI): Track the DeFi Pulse Index, which aggregates the performance of major DeFi tokens, including those on Uniswap.

- Integration with Other Tools: DeFi Pulse often integrates with other analytics tools and platforms that provide detailed price data.

- Additional Insights:

- Trending Projects: See which tokens and projects are trending within the DeFi space.

- Historical Data: Access historical data and charts to analyze trends over time.

Using Dune Analytics for Uniswap Data

Dune Analytics is a powerful platform that allows users to create custom dashboards and visualizations for on-chain data, including detailed Uniswap metrics:

- Access Dune Analytics:

- Visit the Website: Navigate to Dune Analytics.

- Sign Up or Log In: Create an account or log in to access more advanced features and save custom queries.

- Explore Uniswap Dashboards:

- Search for Uniswap: Use the search bar to find existing dashboards and queries related to Uniswap.

- View Pre-Built Dashboards: There are many community-created dashboards that track various Uniswap metrics, including token prices, trading volumes, and liquidity pools.

- Custom Queries:

- Create a Query: If you have SQL knowledge, you can create custom queries to extract specific data from the Ethereum blockchain.

- Price Data: Query and visualize price data for specific tokens traded on Uniswap. For example, you can create a dashboard to track the price of ETH/USDT over time.

- Analyze Data:

- Visualizations: Use Dune’s visualization tools to create charts and graphs that make the data easier to understand and interpret.

- Share Dashboards: Share your custom dashboards with the community or keep them private for personal analysis.

- Using Templates:

- Pre-Built Templates: Utilize templates for common queries and dashboards to save time and get immediate insights.

- Modify Templates: Customize these templates to fit your specific needs and track the metrics that are most relevant to your trading strategy.

Using Crypto Price Aggregators

CoinGecko for Uniswap Prices

CoinGecko is a comprehensive cryptocurrency data aggregator that provides detailed information on various tokens, including those traded on Uniswap:

- Access CoinGecko:

- Visit the Website: Go to CoinGecko.

- Search for Uniswap: Use the search bar to find Uniswap (UNI) or any specific token traded on Uniswap.

- View Price Information:

- Current Price: The token page will display the current price, price change (24h), and market capitalization.

- Historical Data: Scroll down to access historical price data, including daily, weekly, monthly, and yearly price charts.

- Market Data: View detailed market data such as trading volume, supply, and market rank.

- Additional Features:

- Exchanges: Check the list of exchanges where the token is traded, including Uniswap, with links to trading pairs and volumes.

- Alerts: Set up price alerts to receive notifications when a token reaches a certain price point.

- Portfolio Tracker: Use CoinGecko’s portfolio feature to track the performance of your holdings over time.

CoinMarketCap Uniswap Price Tracking

CoinMarketCap is another popular cryptocurrency price tracking website that offers extensive data on tokens and market activity:

- Access CoinMarketCap:

- Visit the Website: Navigate to CoinMarketCap.

- Search for Uniswap: Enter “Uniswap” or the specific token name in the search bar to find the relevant token page.

- View Token Prices:

- Current Market Data: The token page provides current price, market cap, volume, and circulating supply.

- Price Charts: Access interactive price charts with customizable time frames to analyze price trends and historical performance.

- Explore Additional Data:

- Market Pairs: See all trading pairs for the token across different exchanges, including Uniswap, with information on volumes and price differences.

- Market Rankings: View the token’s ranking in the overall cryptocurrency market based on market cap.

- Historical Data: Download historical price data for in-depth analysis and tracking.

- Advanced Tools:

- Price Alerts: Set up price alerts to receive updates when a token reaches your specified price target.

- API Access: Use CoinMarketCap’s API for automated access to price data and other market information.

- Watchlist: Add tokens to your watchlist for quick access to their price information and market data.

Using Decentralized Finance Dashboards

Zapper for Real-Time Prices

Zapper is a comprehensive DeFi dashboard that allows users to manage and track their DeFi investments, including real-time price tracking:

- Access Zapper:

- Visit the Website: Go to Zapper.

- Connect Your Wallet: Click on “Connect Wallet” and choose your preferred wallet (e.g., MetaMask, Trust Wallet). Follow the prompts to authorize the connection.

- View Real-Time Prices:

- Dashboard Overview: Once your wallet is connected, the Zapper dashboard will display an overview of your portfolio, including real-time prices of the assets you hold.

- Token Details: Click on specific tokens in your portfolio to see detailed price information, including current price, 24-hour change, and historical performance.

- Explore Additional Features:

- DeFi Investments: Track your investments across various DeFi protocols, including Uniswap liquidity pools and staking.

- Yield Farming: Monitor the performance of your yield farming activities, with detailed metrics on returns and price movements.

- Transaction History: View a comprehensive history of your transactions, including swaps, liquidity provision, and withdrawals.

- Custom Alerts:

- Price Alerts: Set up alerts to notify you of significant price movements or when a token reaches a specific price point.

- Performance Metrics: Customize your dashboard to highlight key performance metrics that are most relevant to your investment strategy.

Zerion for Price Monitoring

Zerion is another powerful DeFi dashboard that offers detailed monitoring of cryptocurrency prices and portfolio performance:

- Access Zerion:

- Visit the Website: Go to Zerion.

- Connect Your Wallet: Click on “Connect Wallet” and select your wallet provider. Follow the prompts to link your wallet securely.

- Monitor Prices:

- Portfolio Overview: The main dashboard provides an overview of your portfolio, including real-time prices of the assets you hold.

- Token Price Details: Click on individual tokens to access detailed price information, including current price, historical charts, and market trends.

- Advanced Features:

- DeFi Integrations: Zerion integrates with multiple DeFi protocols, allowing you to track and manage your investments in one place.

- Swap Tokens: Easily swap tokens directly from the Zerion interface, with real-time price updates and transaction cost estimates.

- Liquidity Tracking: Monitor your liquidity positions on Uniswap and other platforms, including detailed analytics on returns and pool performance.

- Custom Dashboards:

- Personalized Views: Customize your dashboard to focus on the metrics and assets that matter most to you.

- Price Notifications: Set up price notifications to receive alerts on significant market movements or when tokens reach specified price levels.

- Historical Analysis: Access detailed historical data to analyze the performance of your investments over time.

API Access for Uniswap v3 Prices

Integrating Uniswap API

The Uniswap API provides developers with access to real-time data about the Uniswap v3 protocol, including token prices, trading volumes, and liquidity data:

- Accessing the Uniswap API:

- Visit the Documentation: Go to the Uniswap API documentation to understand the available endpoints and usage guidelines.

- API Key: Currently, Uniswap API does not require an API key for basic access, but always check the latest documentation for any updates or changes.

- Getting Started:

- Base URL: The base URL for the Uniswap API is

https://api.uniswap.org/. - Endpoints: Common endpoints include

/v3/poolsfor liquidity data,/v3/tokensfor token details, and/v3/tradesfor recent trades.

- Base URL: The base URL for the Uniswap API is

- Example Request:

- Fetch Token Prices: To fetch prices for a specific token, you might use an endpoint like

/v3/tokens/{token_address}/price.

- Fetch Token Prices: To fetch prices for a specific token, you might use an endpoint like

- Advanced Integrations:

- Webhooks: Set up webhooks to get real-time updates on significant events like price changes or liquidity additions.

- Data Analytics: Integrate the API data into your data analytics tools for comprehensive analysis and visualization.

Using The Graph for Price Data

The Graph is a decentralized protocol for indexing and querying blockchain data. It can be used to fetch detailed price data from Uniswap v3:

- Accessing The Graph:

- Visit the Graph Explorer: Go to the Graph Explorer to browse and use existing subgraphs or create your own.

- Uniswap Subgraphs: Search for Uniswap v3 subgraphs, which index data from the Uniswap protocol.

- Getting Started:

- GraphQL Endpoint: Each subgraph has a unique GraphQL endpoint you can use to query data. For Uniswap v3, it might look like

https://api.thegraph.com/subgraphs/name/uniswap/uniswap-v3. - Query Example: Use GraphQL queries to fetch price data, liquidity, and other metrics.

- GraphQL Endpoint: Each subgraph has a unique GraphQL endpoint you can use to query data. For Uniswap v3, it might look like

- Example Query:

- Fetch Token Prices: An example query to fetch the latest price of a token could include the token’s ID, symbol, name, and derived price in ETH.

- Advanced Features:

- Custom Subgraphs: If the existing subgraphs do not meet your needs, you can create your own to index specific data.

- Analytics and Dashboards: Integrate data fetched via The Graph into your analytics platforms and dashboards for real-time monitoring and insights.