To switch to Uniswap V3, connect your wallet to the V3 interface and migrate your liquidity using the provided tools.

Introduction to Uniswap V3

Overview of Uniswap V3

Uniswap V3 is the latest iteration of the decentralized exchange (DEX) Uniswap, launched on May 5, 2021. This version introduces significant advancements in decentralized finance (DeFi), focusing on capital efficiency, flexibility, and user control. Uniswap V3 leverages the same automated market maker (AMM) model as its predecessors but includes several enhancements that make it more powerful and user-friendly. The introduction of concentrated liquidity and multiple fee tiers sets Uniswap V3 apart, allowing liquidity providers to earn higher returns and traders to benefit from reduced slippage.

Key Features of Uniswap V3

Uniswap V3 includes a range of new features designed to improve the trading and liquidity provision experience:

- Concentrated Liquidity: This feature allows liquidity providers to allocate their capital within specific price ranges, rather than spreading it uniformly across the entire price curve. This concentration increases capital efficiency and potential returns, as liquidity is more effectively utilized where trading activity is highest.

- Multiple Fee Tiers: Uniswap V3 introduces three distinct fee tiers (0.05%, 0.3%, and 1%) to accommodate different levels of risk and volatility across various trading pairs. Liquidity providers can choose the most appropriate fee tier based on their expectations of market conditions and their risk tolerance.

- Range Orders: Range orders enable users to set limit orders within specified price ranges, similar to traditional limit orders on centralized exchanges. This gives traders more control over their trading strategies and execution.

- Non-Fungible Liquidity Positions: Each liquidity position in Uniswap V3 is represented as a non-fungible token (NFT), allowing for precise management and transferability of liquidity assets. This feature provides liquidity providers with greater flexibility and control over their positions.

- Improved Oracle Mechanisms: Uniswap V3 enhances its built-in time-weighted average price (TWAP) oracles, making them more efficient and secure. These reliable oracles are crucial for accurate price feeds and reducing the risk of exploitative arbitrage.

- Enhanced User Interface: The user interface of Uniswap V3 has been streamlined for better usability, featuring intuitive navigation and improved analytical tools. These enhancements help users manage their trades and liquidity positions more effectively.

Preparing to Switch to Uniswap V3

Checking Compatibility

Before switching to Uniswap V3, it’s essential to ensure that your current setup is compatible with the new platform:

- Supported Wallets: Verify that your cryptocurrency wallet is supported by Uniswap V3. Popular wallets like MetaMask, Trust Wallet, Coinbase Wallet, and WalletConnect are compatible. Ensure that you have the latest version of your wallet installed.

- Ethereum Network: Uniswap V3 operates on the Ethereum network. Ensure your wallet is set to the Ethereum mainnet to interact with Uniswap V3 properly.

- Sufficient ETH Balance: Ensure you have enough ETH in your wallet to cover gas fees for transactions, such as migrating liquidity or executing trades. Gas fees can vary, so having an adequate balance is crucial for seamless operations.

Backing Up Your Wallet

Securing your wallet is a critical step before switching to Uniswap V3. Here’s how to back up your wallet:

- Seed Phrase: Ensure that you have securely stored your seed phrase (also known as a recovery phrase). This phrase is crucial for recovering your wallet if you lose access. Write it down and keep it in a safe, offline location.

- Private Keys: If your wallet provides access to private keys, ensure these are also backed up securely. Never share your private keys or seed phrase with anyone.

- Wallet Backup: Many wallets offer a backup feature that allows you to save your wallet’s data securely. Use this feature to create a backup and store it in a safe location.

- Enable Two-Factor Authentication (2FA): If your wallet or the associated exchange supports 2FA, enable it to add an extra layer of security to your account.

Connecting Your Wallet to Uniswap V3

Supported Wallets

Uniswap V3 supports a variety of popular cryptocurrency wallets, ensuring compatibility and ease of use for a wide range of users:

- MetaMask: A widely-used browser extension wallet that supports Ethereum and ERC-20 tokens.

- Trust Wallet: A mobile wallet that supports multiple blockchains and is known for its user-friendly interface.

- Coinbase Wallet: A mobile wallet from Coinbase that allows users to manage their Ethereum and ERC-20 tokens.

- WalletConnect: A protocol that connects decentralized applications (DApps) to mobile wallets using QR code scanning or deep linking.

Step-by-Step Connection Guide

Connecting your wallet to Uniswap V3 is a straightforward process. Follow these steps to get started:

- Open Uniswap V3:

- Navigate to the Uniswap V3 interface by visiting the official Uniswap website (https://uniswap.vn/) and selecting the “Launch App” button.

- Connect Your Wallet:

- Once on the Uniswap V3 app interface, click on the “Connect Wallet” button, typically located in the top right corner of the page.

- Choose Your Wallet:

- A pop-up window will appear with a list of supported wallets. Select your wallet from the options provided (e.g., MetaMask, Trust Wallet, Coinbase Wallet, WalletConnect).

- Authorize Connection:

- Depending on the wallet you are using, you may need to authorize the connection.

- For MetaMask, a browser extension window will open. Click “Next” to select the account you want to connect, then click “Connect” to authorize.

- For Trust Wallet or Coinbase Wallet, open the wallet app on your mobile device, scan the QR code presented by Uniswap (if using WalletConnect), or follow the in-app prompts to authorize the connection.

- For WalletConnect, you will either scan a QR code or click a deep link to connect.

- Depending on the wallet you are using, you may need to authorize the connection.

- Confirm Connection:

- Once the wallet is connected, you will see your wallet address displayed on the Uniswap V3 interface, indicating a successful connection.

- Start Trading or Providing Liquidity:

- With your wallet connected, you can now start trading tokens, providing liquidity, or exploring other features of Uniswap V3. Ensure you have enough ETH to cover gas fees for any transactions you plan to execute.

Migrating Liquidity to Uniswap V3

Understanding Liquidity Migration

Migrating liquidity to Uniswap V3 involves transferring your assets from Uniswap V2 or other liquidity pools to the new V3 platform. This migration is essential to take advantage of Uniswap V3’s enhanced features, such as concentrated liquidity and multiple fee tiers, which offer better capital efficiency and potential returns for liquidity providers. Understanding the process and the benefits of migrating liquidity can help you make an informed decision.

- Benefits of Migrating:

- Enhanced Capital Efficiency: Concentrated liquidity allows you to allocate your assets more effectively within specific price ranges, maximizing potential returns.

- Flexible Fee Tiers: Choose from multiple fee tiers (0.05%, 0.3%, and 1%) based on the volatility and risk profile of your chosen trading pairs.

- Improved Trading Experience: Enjoy reduced slippage and better trade execution, thanks to deeper liquidity at specific price points.

Steps to Migrate Your Liquidity

Migrating liquidity to Uniswap V3 is a straightforward process. Follow these steps to ensure a smooth transition:

- Prepare Your Wallet:

- Ensure that your wallet is connected to Uniswap V3 and has sufficient ETH to cover gas fees for the migration process.

- Access the Migration Tool:

- Navigate to the Uniswap V3 interface and look for the migration tool. This tool is specifically designed to help users transfer their liquidity from Uniswap V2 to V3.

- Select Liquidity Pools:

- In the migration tool, select the liquidity pools you want to migrate. The tool will display your current positions in Uniswap V2, allowing you to choose which assets to transfer.

- Approve Token Transfers:

- For each token pair you are migrating, you will need to approve the token transfer. This authorization allows Uniswap V3 to move your assets from V2 to V3. Confirm the approval in your wallet.

- Set Price Ranges:

- One of the key features of Uniswap V3 is the ability to set concentrated liquidity within specific price ranges. Define the price range for your liquidity position based on your strategy and market expectations.

- Confirm and Migrate:

- After setting the price ranges, review your migration details and confirm the transaction. Your assets will be transferred to the selected liquidity pools in Uniswap V3.

- Monitor Your Positions:

- Once the migration is complete, monitor your liquidity positions in Uniswap V3. You can adjust your price ranges and manage your positions as needed to optimize your returns.

Trading on Uniswap V3

How to Execute Trades

Executing trades on Uniswap V3 is a simple process, but it’s essential to follow the correct steps to ensure successful transactions. Here’s a detailed guide:

- Connect Your Wallet:

- First, ensure your Ethereum wallet (e.g., MetaMask, Trust Wallet, Coinbase Wallet) is connected to the Uniswap V3 interface. If not, follow the steps in the “Connecting Your Wallet to Uniswap V3” section.

- Select the Tokens:

- On the Uniswap V3 interface, choose the token you wish to swap from and the token you wish to receive. You can do this by clicking on the token dropdown menus and selecting your desired tokens.

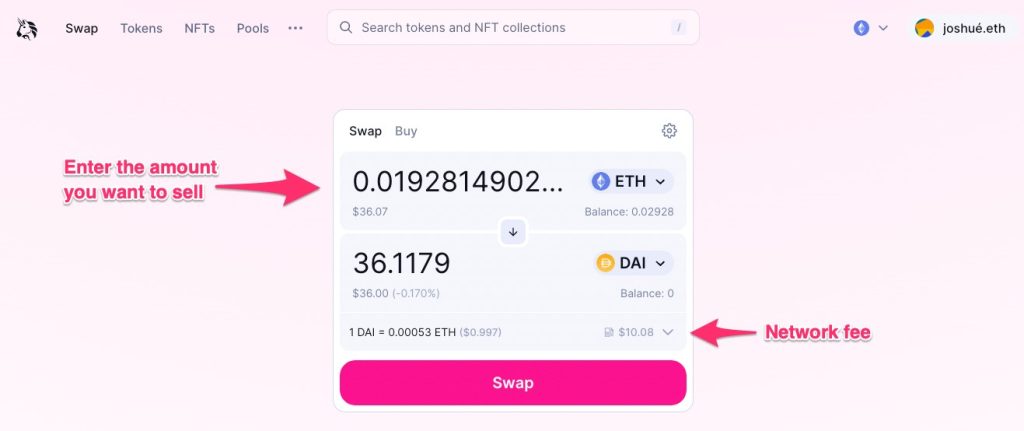

- Enter the Amount:

- Input the amount of the token you want to swap. The interface will automatically display the estimated amount of the token you will receive in return, based on the current exchange rate.

- Review Price and Fees:

- Review the price impact and the liquidity provider fee. Uniswap V3 provides real-time data on the slippage and fee structure, ensuring you are aware of the costs associated with the trade.

- Approve the Token (if necessary):

- If you are swapping a token for the first time, you may need to approve the token for trading. This step allows the Uniswap smart contract to access your token balance. Confirm the approval transaction in your wallet.

- Execute the Trade:

- After approval, click the “Swap” button to execute the trade. A confirmation window will appear, showing the details of the transaction. Confirm the transaction in your wallet to complete the swap.

- Transaction Confirmation:

- Once confirmed, your transaction will be processed on the Ethereum blockchain. You can monitor the status through your wallet or an Ethereum block explorer like Etherscan. The new tokens will appear in your wallet upon successful completion.

Understanding New Trading Features

Uniswap V3 introduces several new trading features that enhance the trading experience and provide more control over your transactions:

- Concentrated Liquidity:

- Liquidity in Uniswap V3 is concentrated within specific price ranges, allowing traders to benefit from deeper liquidity and reduced slippage at these ranges. This results in better execution prices, especially for large trades.

- Range Orders:

- Uniswap V3 allows traders to set range orders, similar to limit orders on traditional exchanges. This feature lets you specify a price range for buying or selling tokens, providing greater control over trade execution. Range orders help in executing trades at more favorable prices, aligning with your trading strategy.

- Multiple Fee Tiers:

- Uniswap V3 introduces multiple fee tiers (0.05%, 0.3%, and 1%) for different trading pairs. Traders can choose pairs with lower fees for less volatile assets, reducing overall trading costs. This flexibility ensures that you can optimize your trading strategies based on the nature of the assets.

- Improved Price Oracles:

- Uniswap V3 features enhanced price oracles that provide more accurate and secure price feeds. These oracles use time-weighted average prices (TWAPs) to mitigate the impact of price manipulation and provide reliable data for trading and DeFi applications.

- User Interface Enhancements:

- The Uniswap V3 interface is designed for better usability, with clear visualizations and detailed analytics. Traders can access real-time data on price movements, liquidity depths, and historical performance, helping them make informed decisions.

Managing Liquidity Positions on Uniswap V3

Setting Up Concentrated Liquidity

Uniswap V3 introduces the concept of concentrated liquidity, allowing liquidity providers to specify price ranges within which their capital is deployed. This feature enhances capital efficiency and potentially increases returns. Here’s how to set up concentrated liquidity:

- Connect Your Wallet:

- Ensure your wallet is connected to the Uniswap V3 interface. Follow the connection steps as detailed earlier.

- Navigate to the Pool Section:

- Go to the “Pool” section on the Uniswap V3 interface. Click on “Add Liquidity” to start the process.

- Select Token Pair:

- Choose the pair of tokens you want to provide liquidity for. Enter the token symbols in the respective fields.

- Specify Price Range:

- Define the price range within which you want your liquidity to be active. Use the sliders or input the exact minimum and maximum prices. This range determines where your liquidity will be most concentrated and utilized.

- Enter Amounts:

- Enter the amount of each token you wish to deposit into the liquidity pool. The interface will show the required amounts based on your specified price range and current market conditions.

- Approve Tokens:

- If it’s your first time adding liquidity for this pair, you’ll need to approve the token transfers. Confirm these approvals in your wallet.

- Confirm and Add Liquidity:

- Review the details, including the price range, token amounts, and estimated fees. Click “Add Liquidity” and confirm the transaction in your wallet. Your liquidity position will now be active within the specified price range.

Monitoring and Adjusting Positions

After setting up your liquidity position, it’s crucial to monitor and adjust it as needed to optimize returns and manage risk. Here’s how to effectively manage your positions:

- Access Your Positions:

- Go to the “Pool” section on the Uniswap V3 interface to view your active liquidity positions. Each position will display details such as token pair, price range, and current value.

- Track Performance:

- Monitor the performance of your liquidity positions by checking metrics like fees earned, current liquidity, and price changes. Uniswap V3 provides detailed analytics to help you assess the effectiveness of your strategy.

- Adjust Price Ranges:

- Market conditions can change, making it necessary to adjust your price ranges. If the market price moves out of your specified range, your liquidity will no longer be active. To adjust:

- Select the position you want to modify.

- Click “Edit” and specify the new price range.

- Confirm the adjustments in your wallet.

- Market conditions can change, making it necessary to adjust your price ranges. If the market price moves out of your specified range, your liquidity will no longer be active. To adjust:

- Add or Remove Liquidity:

- You can add more tokens to your existing positions or remove part of your liquidity if needed. To do this:

- Select the position you wish to modify.

- Choose “Add” or “Remove” liquidity.

- Enter the amounts and confirm the transaction in your wallet.

- You can add more tokens to your existing positions or remove part of your liquidity if needed. To do this:

- Reinvesting Fees:

- Fees earned from providing liquidity can be reinvested to compound returns. Regularly check your earnings and consider adding them back into your liquidity positions.

- Stay Informed:

- Keep up-to-date with market trends and Uniswap V3 updates. Participating in community forums and following DeFi news can provide insights that help optimize your liquidity strategy.

Troubleshooting Common Issues

Connection Problems

Experiencing connection problems when trying to use Uniswap V3 can be frustrating. Here are common issues and their solutions:

- Wallet Not Connecting:

- Issue: Your wallet fails to connect to the Uniswap V3 interface.

- Solutions:

- Ensure you are using a supported wallet (e.g., MetaMask, Trust Wallet, Coinbase Wallet, WalletConnect).

- Check that your browser or mobile app is up-to-date.

- Clear your browser cache and cookies.

- Disable any browser extensions that might be interfering with the connection process.

- Try reconnecting your wallet or restarting your browser/mobile app.

- Network Issues:

- Issue: You are experiencing network errors or delays.

- Solutions:

- Confirm that your internet connection is stable.

- Check the Ethereum network status for any widespread issues or congestion.

- If using MetaMask, ensure it is set to the Ethereum mainnet, not a testnet or other network.

- Switch to a different internet connection or device if possible.

- Authorization Errors:

- Issue: Errors occur when trying to approve token transfers or transactions.

- Solutions:

- Ensure you have sufficient ETH in your wallet to cover gas fees.

- Re-authorize the token transfer and confirm the transaction in your wallet.

- Double-check that you are using the correct wallet address and have given the appropriate permissions.

- Unresponsive Interface:

- Issue: The Uniswap interface becomes unresponsive or slow.

- Solutions:

- Refresh the Uniswap page.

- Clear your browser cache and cookies.

- Try accessing Uniswap V3 using a different browser or device.

Liquidity Migration Challenges

Migrating liquidity from Uniswap V2 to V3 can present several challenges. Here are common issues and how to resolve them:

- Insufficient Gas Fees:

- Issue: Transactions fail due to insufficient gas fees.

- Solutions:

- Ensure you have enough ETH in your wallet to cover the gas fees for migration.

- Check current gas prices using tools like EthGasStation and adjust your gas fee settings accordingly.

- Consider migrating during times of lower network activity to reduce gas costs.

- Token Approval Issues:

- Issue: Problems occur when approving tokens for migration.

- Solutions:

- Confirm that you have sufficient token balances in your wallet.

- Re-authorize the token transfer by following the prompts on the Uniswap V3 interface.

- Ensure your wallet is correctly connected and you have given the necessary permissions.

- Price Range Setting Problems:

- Issue: Difficulty in setting appropriate price ranges for your liquidity position.

- Solutions:

- Review the market data and historical price trends to set a realistic price range.

- Use the Uniswap V3 interface tools and analytics to help determine optimal price ranges.

- Experiment with different ranges to find the best strategy for your liquidity provision.

- Transaction Failures:

- Issue: Transactions fail to complete successfully.

- Solutions:

- Double-check all transaction details before confirming.

- Ensure that your wallet is correctly connected and has enough ETH for gas fees.

- Monitor the transaction status using Etherscan and retry if necessary.

- Stuck Transactions:

- Issue: Transactions get stuck or remain pending for a long time.

- Solutions:

- Increase the gas fee (using the “speed up” option in your wallet) to prioritize the transaction.

- If a transaction is stuck, you can attempt to cancel it by sending a new transaction with the same nonce and a higher gas fee.