No, QuickSwap and Uniswap are not the same. QuickSwap operates on the Polygon network, while Uniswap is based on Ethereum.

Overview of QuickSwap and Uniswap

Introduction to QuickSwap

QuickSwap is a decentralized exchange (DEX) operating on the Polygon network. Leveraging the scalability and low transaction costs of Polygon, QuickSwap offers fast and affordable transactions. It utilizes an automated market maker (AMM) model, enabling users to trade ERC-20 tokens directly from their wallets without relying on a traditional order book. QuickSwap’s key features include:

- Low Fees: By operating on Polygon, QuickSwap benefits from significantly lower transaction fees compared to Ethereum-based DEXs.

- High Speed: Transactions on QuickSwap are processed quickly, providing a seamless trading experience.

- User-Friendly Interface: Designed with simplicity in mind, QuickSwap’s interface is easy to navigate, making it accessible for both novice and experienced traders.

Introduction to Uniswap

Uniswap is one of the most popular and widely used decentralized exchanges in the DeFi space. Built on the Ethereum blockchain, Uniswap also uses an automated market maker (AMM) model to facilitate token swaps. Unlike traditional exchanges, Uniswap does not use an order book; instead, it relies on liquidity pools provided by users. Key features of Uniswap include:

- Decentralization: Uniswap operates in a fully decentralized manner, with no central authority controlling the platform.

- Liquidity Pools: Users can contribute to liquidity pools, earning fees from trades that occur within those pools.

- Vast Token Availability: Uniswap supports a wide range of ERC-20 tokens, making it a versatile platform for traders.

- Innovation: Uniswap has been a pioneer in the DeFi space, continuously introducing new features and improvements to enhance user experience and security.

Key Features of QuickSwap

Speed and Efficiency

QuickSwap is renowned for its exceptional speed and efficiency, making it a standout choice in the decentralized exchange (DEX) landscape. Key aspects include:

- Fast Transactions: QuickSwap leverages the Polygon network’s high throughput capabilities, allowing for rapid transaction processing. Users experience minimal delays, enhancing their trading efficiency.

- Low Latency: The network’s architecture ensures low latency, meaning trades are executed almost instantaneously, providing a seamless trading experience.

- Scalability: QuickSwap’s infrastructure can handle a large volume of transactions without compromising performance, making it suitable for high-frequency trading.

Integration with Polygon

One of QuickSwap’s most significant advantages is its integration with the Polygon network. This integration brings several benefits:

- Low Transaction Fees: Operating on Polygon means significantly reduced gas fees compared to Ethereum-based exchanges. This cost efficiency is particularly beneficial for traders conducting frequent transactions or dealing with smaller amounts.

- Enhanced Security: Polygon inherits the security features of the Ethereum network while providing additional security layers. This ensures that users’ assets and transactions are well-protected.

- Interoperability: QuickSwap’s integration with Polygon facilitates seamless interoperability with other Polygon-based decentralized applications (dApps). This opens up a broader ecosystem for users, enhancing their overall DeFi experience.

- Accessibility: The integration makes it easier for users to access QuickSwap from various platforms and wallets, increasing its accessibility and user base.

Key Features of Uniswap

Automated Market Maker (AMM) Model

Uniswap revolutionized the decentralized exchange landscape with its innovative AMM model. Key aspects of this model include:

- Liquidity Pools: Unlike traditional order book exchanges, Uniswap relies on liquidity pools. Users provide liquidity by depositing pairs of ERC-20 tokens into these pools, enabling seamless token swaps.

- Constant Product Formula: Uniswap uses the constant product formula (x * y = k) to maintain the balance between token pairs in a pool. This ensures liquidity remains available regardless of the trade size.

- Permissionless Trading: The AMM model allows for permissionless trading, meaning anyone can trade tokens or provide liquidity without needing approval from a central authority.

- Incentives for Liquidity Providers: Liquidity providers earn a share of the trading fees generated from their pools, incentivizing them to contribute and maintain liquidity.

Adoption and Popularity

Uniswap has become one of the most popular and widely adopted decentralized exchanges in the DeFi space. Factors contributing to its popularity include:

- First-Mover Advantage: As one of the first DEXs to implement the AMM model, Uniswap quickly gained traction and established itself as a leader in the DeFi ecosystem.

- Wide Range of Tokens: Uniswap supports a vast array of ERC-20 tokens, offering users extensive options for trading and liquidity provision.

- Community Governance: Uniswap’s governance is decentralized, with the UNI token enabling community members to vote on protocol changes and upgrades. This fosters a sense of ownership and engagement among users.

- Ecosystem Integration: Uniswap’s protocol is integrated into numerous DeFi projects and platforms, enhancing its utility and accessibility. This broad integration further solidifies its position within the DeFi ecosystem.

- Continuous Innovation: Uniswap consistently introduces new features and improvements, such as Uniswap V3, which offers increased capital efficiency and concentrated liquidity. This ongoing innovation keeps the platform relevant and competitive.

Differences in Network and Ecosystem

QuickSwap on Polygon

QuickSwap operates on the Polygon network, providing several distinct advantages:

- Low Transaction Fees: Polygon’s architecture significantly reduces transaction fees, making trading on QuickSwap more cost-effective, especially for frequent or small-volume trades.

- High Throughput: Polygon’s high throughput capabilities ensure that QuickSwap can handle a large number of transactions quickly and efficiently, minimizing delays and congestion.

- Layer 2 Scaling Solution: As a Layer 2 scaling solution for Ethereum, Polygon enhances the scalability of QuickSwap, allowing it to benefit from Ethereum’s security while offering superior performance and lower costs.

- Interoperability with Ethereum: QuickSwap users can easily bridge assets between Ethereum and Polygon, providing flexibility and access to a broader range of decentralized applications (dApps) and services.

- Growing Ecosystem: Polygon’s expanding ecosystem includes numerous dApps, DeFi projects, and NFTs, offering QuickSwap users diverse opportunities for engagement and investment within a vibrant community.

Uniswap on Ethereum

Uniswap is built on the Ethereum blockchain, and this choice impacts its network and ecosystem in several ways:

- Wide Adoption: Ethereum’s status as the leading smart contract platform has contributed to Uniswap’s extensive adoption and integration across the DeFi space. Many DeFi projects and tokens are Ethereum-based, ensuring a vast selection for Uniswap users.

- Robust Security: Ethereum’s mature and well-established network provides robust security features, ensuring the safety of users’ funds and transactions on Uniswap.

- Higher Transaction Fees: Operating on Ethereum means that Uniswap users often face higher gas fees, particularly during periods of network congestion. This can be a drawback for smaller trades or frequent transactions.

- Network Congestion: Ethereum’s popularity can lead to network congestion, causing delays in transaction processing times. This can impact the user experience, especially during peak periods.

- Strong Developer Community: Ethereum boasts a large and active developer community, continuously contributing to the improvement and innovation of the network. This has led to numerous upgrades and enhancements that benefit platforms like Uniswap.

- Decentralized Governance: Uniswap’s governance model allows the community to propose and vote on changes to the protocol, using the UNI token. This decentralized approach ensures that the platform evolves according to the needs and preferences of its users.

Liquidity and Token Swapping Mechanisms

QuickSwap Liquidity Provision

QuickSwap’s liquidity provision mechanisms are designed to ensure efficient and cost-effective trading experiences. Key aspects include:

- Liquidity Pools: QuickSwap uses liquidity pools where users deposit pairs of ERC-20 tokens. These pools provide the liquidity necessary for token swaps on the platform.

- Yield Farming: QuickSwap offers yield farming incentives to liquidity providers. By staking their liquidity pool (LP) tokens, users can earn additional rewards, enhancing the attractiveness of providing liquidity.

- Impermanent Loss Protection: While impermanent loss is inherent in AMM models, QuickSwap’s integration with the Polygon network mitigates some risks by reducing transaction costs and allowing for more frequent adjustments to liquidity positions.

- Flexible Pool Creation: Users can create new liquidity pools for any ERC-20 token pair, providing flexibility and fostering a diverse range of trading pairs on the platform.

- Rewards and Fees: Liquidity providers earn a share of the trading fees generated in their pools. These fees are proportionally distributed based on the amount of liquidity provided, offering a continuous income stream for active participants.

Uniswap Token Swapping

Uniswap’s token swapping mechanisms are integral to its functionality and popularity. Key features include:

- Automated Market Maker (AMM) Model: Uniswap employs an AMM model that eliminates the need for traditional order books. Instead, it uses smart contracts to automatically determine token prices based on the ratio of tokens in a liquidity pool.

- Constant Product Formula: Uniswap’s AMM uses the constant product formula (x * y = k) to ensure that the product of the quantities of two tokens in a pool remains constant, maintaining liquidity regardless of trade size.

- Permissionless Trading: Uniswap allows for permissionless token swaps, meaning anyone can trade tokens without needing approval or going through a central authority. This openness has contributed to its widespread adoption.

- Vast Token Selection: Uniswap supports a wide range of ERC-20 tokens, offering users extensive options for trading and liquidity provision. This diversity makes it a versatile platform for various trading strategies.

- User-Friendly Interface: The platform’s interface is designed to be intuitive and easy to use, facilitating seamless token swaps for both novice and experienced traders.

- Fee Structure: A standard fee of 0.3% is charged on all trades, which is distributed to liquidity providers in the respective pools. This fee structure incentivizes users to contribute to liquidity pools, ensuring the availability of liquidity for token swaps.

User Experience and Interface

QuickSwap User Interface

The user interface (UI) of QuickSwap is designed to be intuitive and user-friendly, catering to both novice and experienced traders. Key features include:

- Clean and Simple Design: QuickSwap’s interface emphasizes simplicity, making it easy for users to navigate and execute trades without confusion.

- Quick Access to Features: The homepage provides quick access to essential features such as swapping tokens, providing liquidity, and yield farming opportunities.

- Responsive Performance: Leveraging the Polygon network’s high speed, QuickSwap offers responsive performance, with fast transaction confirmations and minimal latency.

- Comprehensive Dashboard: Users can easily view their balances, transaction history, and liquidity positions in a consolidated dashboard, enhancing their ability to manage their portfolios.

- Integration with Wallets: QuickSwap supports a range of wallet integrations, including MetaMask, WalletConnect, and others, ensuring users can securely connect and manage their assets.

- Educational Resources: The platform provides educational resources and guides to help users understand DeFi concepts and navigate the interface effectively.

Uniswap User Interface

Uniswap’s user interface is known for its simplicity and efficiency, making it one of the most accessible platforms in the DeFi space. Key features include:

- Minimalistic Design: Uniswap’s UI focuses on a minimalistic design that prioritizes ease of use and straightforward navigation.

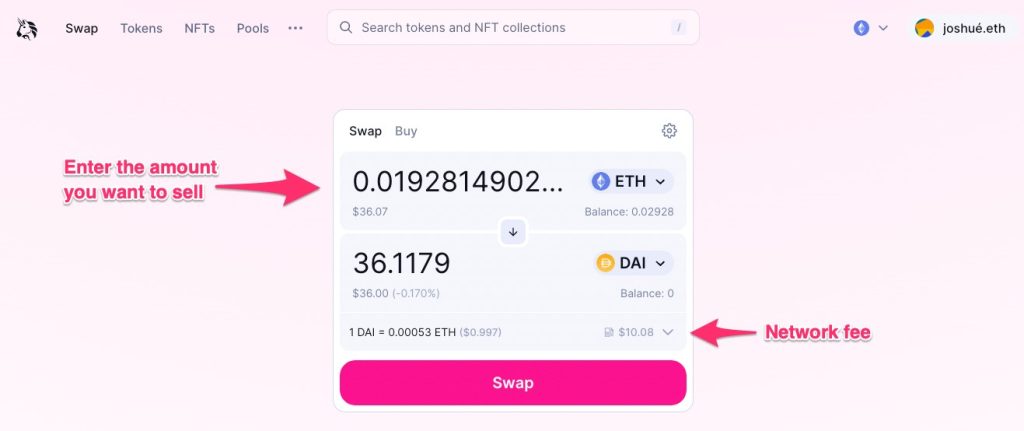

- Easy Token Swapping: The swap interface is designed to be highly intuitive, allowing users to select tokens, enter amounts, and execute trades with just a few clicks.

- Liquidity Provision Tools: Users can easily provide liquidity to pools through a simple and clear interface that guides them through the process step-by-step.

- Analytics and Insights: Uniswap offers detailed analytics and insights into trading pairs, volume, and liquidity, helping users make informed decisions.

- Wallet Integration: The platform supports various wallet integrations, including MetaMask, Coinbase Wallet, and more, providing flexibility and security for users to manage their assets.

- Responsive and Fast: Despite operating on the Ethereum network, Uniswap ensures responsive and fast performance, with efficient transaction processing and clear status updates.

- Community and Support: Uniswap provides robust community support through forums, social media, and extensive documentation, helping users troubleshoot issues and stay informed about platform updates.

Security and Community Support

Security Measures of QuickSwap

QuickSwap prioritizes the security of its users’ assets and transactions through several key measures:

- Smart Contract Audits: QuickSwap’s smart contracts are rigorously audited by reputable third-party security firms to identify and mitigate vulnerabilities. These audits help ensure the integrity and reliability of the platform.

- Integration with Polygon: Operating on the Polygon network provides additional layers of security, as Polygon benefits from Ethereum’s robust security features while implementing its own enhancements.

- Multi-Signature Wallets: QuickSwap employs multi-signature wallets for managing the platform’s funds, requiring multiple approvals for significant transactions, which reduces the risk of unauthorized access.

- Bug Bounty Programs: QuickSwap offers bug bounty programs to incentivize ethical hackers to identify and report security issues. This proactive approach helps in discovering and addressing potential threats before they can be exploited.

- Continuous Monitoring: The platform continuously monitors network activity for suspicious behavior and potential security breaches, enabling prompt responses to any detected threats.

- User Education: QuickSwap provides resources and guidelines to help users adopt best practices for securing their assets, such as using hardware wallets and enabling two-factor authentication.

Community Support for Uniswap

Uniswap has a strong and active community that plays a vital role in its growth and development. Key aspects of community support include:

- Decentralized Governance: Uniswap’s governance model allows UNI token holders to propose and vote on protocol changes, ensuring that the community has a direct say in the platform’s evolution. This decentralized approach fosters a sense of ownership and involvement.

- Extensive Documentation: Uniswap provides comprehensive documentation and tutorials to help users understand and navigate the platform. This includes guides on using the interface, providing liquidity, and participating in governance.

- Active Forums and Social Media: Uniswap maintains active forums and social media channels where users can discuss issues, share insights, and seek help from the community. These platforms foster collaboration and knowledge sharing.

- Developer Support: Uniswap offers resources and support for developers looking to build on top of its protocol. This includes detailed API documentation, developer guides, and a community of developers who contribute to the platform’s ecosystem.

- Regular Updates and Communication: The Uniswap team regularly communicates with the community through blog posts, announcements, and social media updates. This transparency helps keep users informed about new features, upgrades, and security measures.

- Educational Initiatives: Uniswap supports educational initiatives and partnerships that aim to increase DeFi literacy and awareness. This includes webinars, workshops, and collaborations with educational institutions and organizations.