Yes, Uniswap v2 is still widely used, offering significant liquidity, ease of use, and support for a variety of trading pairs in the DeFi ecosystem.

Overview of Uniswap v2

Uniswap v2 is a decentralized exchange (DEX) protocol built on the Ethereum blockchain, launched in May 2020. It represents a significant upgrade from its predecessor, Uniswap v1, and has introduced numerous enhancements that have improved its functionality and user experience.

Key Features of Uniswap v2

Uniswap v2 offers several key features that distinguish it from other decentralized exchanges and make it a popular choice for traders and developers in the decentralized finance (DeFi) space.

- ERC20/ERC20 Pairs: Unlike Uniswap v1, which only allowed ETH/ERC20 pairs, Uniswap v2 supports direct ERC20 to ERC20 token swaps. This feature simplifies trading and increases the efficiency of liquidity pools.

- Price Oracles: Uniswap v2 integrates a time-weighted average price (TWAP) oracle, which helps in providing reliable on-chain price feeds. These oracles are essential for various DeFi applications, including lending platforms and synthetic assets.

- Flash Swaps: This innovative feature allows users to withdraw up to the full reserves of any ERC20 token on Uniswap and execute arbitrary logic, provided that by the end of the transaction, the tokens are either returned or paid for. This opens up opportunities for complex trading strategies and arbitrage.

- Improved Decentralization and Security: Uniswap v2 leverages the latest in smart contract security practices. Its code is open-source and has been rigorously audited, ensuring a high level of trust and reliability within the community.

Improvements Over Uniswap v1

Uniswap v2 incorporates several improvements over its first iteration, enhancing its overall functionality and user experience.

- Enhanced Liquidity Provision: In Uniswap v2, liquidity providers can create pools for any ERC20/ERC20 pair, allowing for more diverse liquidity options and reducing the dependency on ETH as an intermediary asset.

- More Efficient Swaps: The protocol’s architecture has been optimized for gas efficiency, reducing the cost of transactions and making the platform more accessible to a wider range of users.

- Customizable Pairs: Liquidity providers have more flexibility in creating pairs and managing their investments, which has led to a broader range of trading pairs and increased market depth.

- Improved User Interface: The user interface of Uniswap v2 has been refined to provide a more intuitive and seamless experience for traders, making it easier for both novice and experienced users to navigate the platform.

Uniswap v2 vs. Uniswap v3

Uniswap v3, launched in May 2021, introduced several advanced features and improvements over Uniswap v2, further enhancing the decentralized exchange’s capabilities and efficiency. This section delves into the main differences between Uniswap v2 and Uniswap v3 and examines user adoption trends for both versions.

Main Differences Between v2 and v3

Uniswap v3 offers a range of enhancements and new functionalities that set it apart from Uniswap v2.

- Concentrated Liquidity: One of the most significant innovations in Uniswap v3 is concentrated liquidity. This feature allows liquidity providers (LPs) to allocate their capital within specific price ranges, making their capital more efficient and reducing slippage for traders.

- Multiple Fee Tiers: Uniswap v3 introduces multiple fee tiers (0.05%, 0.3%, and 1%) for different pools, giving LPs the flexibility to choose their risk/reward profile. This change aims to attract more liquidity and accommodate different types of assets.

- Range Orders: Uniswap v3 enables LPs to set range orders, similar to limit orders in traditional finance. This feature allows LPs to earn fees by providing liquidity at specific price points, enhancing the overall trading experience.

- Advanced Oracles: The oracle functionality in Uniswap v3 is significantly improved, offering more reliable and accurate time-weighted average prices (TWAP). This enhancement supports more complex DeFi applications and reduces the risk of oracle manipulation.

- Optimized Gas Costs: Uniswap v3 includes various optimizations to reduce gas costs, making transactions more cost-effective and accessible, particularly during periods of high network congestion.

User Adoption Trends

The introduction of Uniswap v3 has influenced user adoption patterns, with traders and liquidity providers evaluating the benefits of each version.

- Liquidity Distribution: Initially, there was a significant migration of liquidity from Uniswap v2 to v3, driven by the appeal of concentrated liquidity and multiple fee tiers. However, Uniswap v2 still retains a substantial amount of liquidity, particularly for trading pairs that benefit from simpler liquidity provision.

- Trading Volume: Uniswap v3 has seen a steady increase in trading volume due to its enhanced efficiency and lower slippage. Nevertheless, Uniswap v2 continues to handle a significant portion of trades, especially for pairs and strategies that do not require the advanced features of v3.

- User Preferences: Some users prefer the simplicity and lower gas costs of Uniswap v2, particularly for smaller trades and long-tail assets. The choice between v2 and v3 often depends on the specific needs and strategies of traders and liquidity providers.

- DeFi Integrations: Both versions are widely integrated into various DeFi platforms and protocols. However, the advanced functionalities of Uniswap v3 make it a more attractive option for sophisticated DeFi applications requiring precise liquidity management and robust price feeds.

Liquidity and Trading Volume on Uniswap v2

Uniswap v2, despite the introduction of Uniswap v3, continues to maintain significant liquidity and trading volume. This section provides an overview of the current liquidity on Uniswap v2 and analyzes its trading volume.

Current Liquidity on Uniswap v2

Uniswap v2 still holds substantial liquidity, supported by a variety of trading pairs and active liquidity providers.

- Diverse Liquidity Pools: Uniswap v2 offers a wide range of liquidity pools for numerous ERC20 tokens, allowing users to trade and provide liquidity for a diverse set of assets. This diversity attracts liquidity providers looking for stable returns on their investments.

- Total Value Locked (TVL): The total value locked in Uniswap v2 remains considerable, with millions of dollars’ worth of assets staked in liquidity pools. This high TVL reflects ongoing confidence and participation from the DeFi community.

- Stablecoin Pools: Liquidity pools involving stablecoins, such as USDC/ETH and DAI/ETH, continue to attract significant capital due to their lower volatility and consistent trading volume, providing a stable source of fees for liquidity providers.

Trading Volume Analysis

Uniswap v2’s trading volume demonstrates its continued relevance and utility in the DeFi ecosystem.

- Daily Trading Volume: Uniswap v2 consistently records substantial daily trading volumes, with several high-activity pairs driving significant transaction counts. This consistent volume highlights the ongoing demand for trading on Uniswap v2.

- High-Frequency Trading Pairs: Certain trading pairs, particularly those involving popular tokens like ETH, USDT, and UNI, see high trading frequency. These pairs benefit from deep liquidity and lower slippage, making them attractive for traders.

- Long-Tail Assets: Uniswap v2 remains a preferred platform for trading long-tail assets—tokens that have smaller market capitalizations and are less frequently traded. The ability to list any ERC20 token without permission allows niche projects to find liquidity and market participants.

- Impact of Market Conditions: The trading volume on Uniswap v2 is sensitive to overall market conditions. During periods of high volatility or significant market events, Uniswap v2 often sees a spike in trading activity as users seek to capitalize on price movements.

Use Cases for Uniswap v2

Uniswap v2 continues to play an essential role in the decentralized finance (DeFi) ecosystem, offering a range of use cases that make it a preferred choice for many users. This section explores the preferred trading pairs and smart contract compatibility that contribute to its ongoing popularity.

Preferred Trading Pairs

Certain trading pairs on Uniswap v2 are particularly favored due to their liquidity, stability, and trading volume.

- ETH/ERC20 Pairs: Pairs involving Ethereum (ETH) and various ERC20 tokens remain highly popular on Uniswap v2. The ETH/USDT, ETH/USDC, and ETH/DAI pairs are among the most traded, providing deep liquidity and lower slippage for traders.

- Stablecoin Pairs: Pairs involving stablecoins, such as USDC/DAI and USDT/USDC, are preferred for their price stability and low volatility. These pairs are especially useful for users looking to hedge against market volatility or execute arbitrage strategies.

- Long-Tail Assets: Uniswap v2 supports a wide range of less frequently traded tokens, known as long-tail assets. These assets benefit from the permissionless nature of Uniswap, allowing new and niche projects to find liquidity and trading opportunities. Pairs like UNI/ETH and LINK/ETH are notable examples.

- Yield Farming and Incentivized Pairs: Some trading pairs on Uniswap v2 are incentivized through yield farming programs, attracting liquidity providers seeking additional returns. These pairs often include tokens from emerging DeFi projects, enhancing their liquidity and visibility.

Smart Contract Compatibility

Uniswap v2’s architecture and design make it highly compatible with various smart contract applications, facilitating seamless integration with other DeFi protocols.

- Decentralized Exchanges (DEXes): Uniswap v2 serves as a backbone for many decentralized exchanges, providing liquidity and trading functionalities. Its compatibility with other DEXes enables users to benefit from arbitrage opportunities and cross-platform liquidity.

- Lending and Borrowing Platforms: Platforms like Aave and Compound leverage Uniswap v2’s liquidity pools for collateral swaps and liquidations. This integration enhances the efficiency and liquidity of lending protocols, allowing users to swap collateral quickly and at competitive rates.

- Yield Aggregators: Yield aggregators such as Yearn Finance utilize Uniswap v2 to optimize yield farming strategies. By interacting with Uniswap’s liquidity pools, these aggregators can maximize returns for their users through efficient token swaps and liquidity provision.

- Synthetic Assets: Protocols creating synthetic assets, like Synthetix, integrate with Uniswap v2 for price discovery and liquidity. Uniswap’s TWAP oracles provide reliable pricing data, ensuring the accuracy and stability of synthetic asset markets.

- Decentralized Insurance: Decentralized insurance platforms, such as Nexus Mutual, use Uniswap v2 to manage risk pools and execute claims. The ability to swap assets quickly and securely on Uniswap supports the operational efficiency of these insurance protocols.

Advantages of Uniswap v2

Uniswap v2 offers several advantages that contribute to its sustained popularity in the decentralized finance (DeFi) space. These advantages include ease of use and cost-effectiveness, making it an attractive choice for both new and experienced users.

Ease of Use

Uniswap v2 is designed with a user-friendly interface and straightforward functionality, providing a seamless experience for its users.

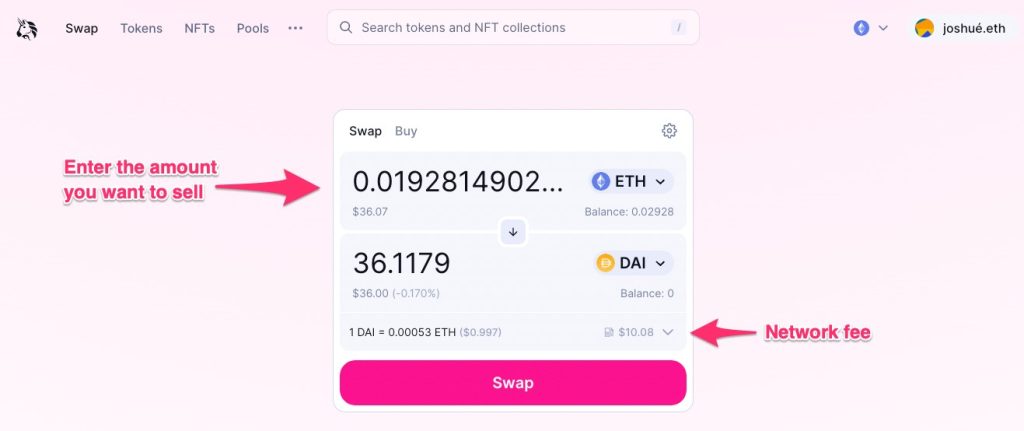

- Simple Interface: The platform’s interface is intuitive, allowing users to easily swap tokens, add liquidity, and remove liquidity without requiring extensive technical knowledge. This simplicity lowers the barrier to entry for new users in the DeFi ecosystem.

- Permissionless Trading: Users can trade any ERC20 token pair without needing to go through a centralized authority or approval process. This permissionless nature empowers users to trade freely and access a wide variety of tokens.

- Transparent and Trustless: Uniswap v2 operates on a trustless system where all transactions are executed via smart contracts. This transparency ensures that users do not need to trust a third party, reducing the risk of fraud and enhancing security.

- No Account Registration: Unlike traditional exchanges, Uniswap v2 does not require users to create accounts or undergo lengthy verification processes. Users can start trading immediately by connecting their Ethereum wallet, such as MetaMask, making the process quick and hassle-free.

- Community Support: Uniswap v2 benefits from a strong community of users and developers who provide support, share knowledge, and contribute to the platform’s development. This community-driven approach helps new users find resources and assistance easily.

Cost-Effectiveness

Uniswap v2 provides cost-effective solutions for trading and liquidity provision, making it a preferred choice for many users.

- Lower Transaction Fees: Compared to traditional exchanges, Uniswap v2 typically offers lower transaction fees. This is particularly beneficial for small traders and frequent users who seek to minimize their costs.

- Efficient Gas Usage: Uniswap v2’s smart contracts are optimized for gas efficiency, reducing the amount of gas required for transactions. This efficiency helps users save on transaction costs, especially during periods of high network congestion.

- No Listing Fees: Projects can list their tokens on Uniswap v2 without incurring listing fees. This fee-free listing model encourages the inclusion of a wide variety of tokens, fostering innovation and diversity in the DeFi space.

- Competitive Trading Fees: Uniswap v2 charges a 0.30% fee per trade, which is distributed to liquidity providers. This fee structure is competitive compared to other decentralized exchanges and provides an incentive for liquidity providers to participate, ensuring deep liquidity and better trading conditions.

- No Withdrawal Limits: Users can withdraw their funds at any time without facing withdrawal limits or additional fees. This flexibility allows users to manage their funds efficiently and respond quickly to market changes.

Community and Developer Support for Uniswap v2

Uniswap v2 benefits from robust community and developer support, which plays a crucial role in its ongoing success and relevance. This section explores the ongoing developments and community initiatives that contribute to the platform’s vibrant ecosystem.

Ongoing Developments

Uniswap v2 continues to see significant contributions from developers and the broader community, ensuring that the platform remains competitive and functional.

- Protocol Enhancements: Developers regularly work on improving the underlying smart contract infrastructure of Uniswap v2, ensuring security, efficiency, and compatibility with other DeFi protocols. These enhancements help maintain the protocol’s robustness and usability.

- Tooling and Integrations: Ongoing development efforts focus on creating tools and integrations that make it easier for users and developers to interact with Uniswap v2. Examples include analytics dashboards, automated trading bots, and integration with wallet services. These tools enhance user experience and broaden the use cases of Uniswap v2.

- Security Audits: Regular security audits and code reviews are conducted to identify and fix potential vulnerabilities. These audits are critical for maintaining user trust and ensuring the safety of funds within the protocol.

- Layer 2 Solutions: Developers are exploring Layer 2 scaling solutions to reduce transaction costs and increase throughput on Uniswap v2. These solutions aim to address scalability issues on the Ethereum network, making Uniswap v2 more accessible and efficient for users.

- Governance Proposals: Although Uniswap governance primarily focuses on the latest version, v3, proposals and discussions often consider backward compatibility and improvements that could benefit v2 users. Active participation in governance ensures that the needs of v2 users are not overlooked.

Community Initiatives

The Uniswap community actively engages in initiatives that support the platform’s growth, education, and user engagement.

- Educational Resources: The community creates and disseminates educational content to help new users understand how to use Uniswap v2 effectively. This includes tutorials, webinars, and documentation that cover everything from basic trading to advanced liquidity provision strategies.

- Hackathons and Developer Grants: Community-driven hackathons and grant programs encourage developers to build on Uniswap v2. These events foster innovation and result in the creation of new tools, features, and integrations that enhance the ecosystem.

- Community Governance: While Uniswap v2 itself is not directly governed, the broader Uniswap governance framework allows v2 users to voice their opinions and contribute to decision-making processes. This inclusive governance model ensures that the community’s interests are represented.

- Liquidity Mining Programs: Community initiatives often include liquidity mining programs that incentivize users to provide liquidity to specific pairs on Uniswap v2. These programs boost liquidity and trading activity, benefiting both users and the protocol.

- Partnerships and Collaborations: The community actively pursues partnerships with other DeFi projects, exchanges, and blockchain platforms. These collaborations expand the reach and utility of Uniswap v2, integrating it into a wider array of DeFi services and products.

Future Prospects of Uniswap v2

Uniswap v2 continues to hold a significant position in the decentralized finance (DeFi) landscape, even as newer versions and protocols emerge. This section examines the potential updates and the ongoing role of Uniswap v2 in the DeFi ecosystem.

Potential Updates

While Uniswap v2 is no longer the latest version, there are still potential updates and improvements that could enhance its functionality and maintain its relevance.

- Layer 2 Integration: Implementing Layer 2 solutions, such as Optimistic Rollups or zk-Rollups, could significantly reduce gas fees and increase transaction throughput. This would make Uniswap v2 more accessible and cost-effective for users, especially during periods of high network congestion.

- Enhanced Security Features: Ongoing security enhancements and audits can further fortify Uniswap v2 against potential vulnerabilities. Introducing advanced security mechanisms and continuous monitoring would ensure the protocol remains a safe environment for trading and liquidity provision.

- User Experience Improvements: Updates to the user interface and experience can make Uniswap v2 more intuitive and user-friendly. Simplifying the process for new users and adding more advanced features for experienced traders can help retain and grow the user base.

- Expanded Oracle Integrations: Integrating more reliable and diverse oracle services can improve the accuracy of price feeds and the overall functionality of DeFi applications built on top of Uniswap v2. This would enhance its appeal for complex DeFi strategies and applications.

- Community-Driven Enhancements: Encouraging community proposals and contributions can lead to innovative updates and features that meet the evolving needs of users. A more decentralized and inclusive approach to development can foster a stronger community bond and drive continuous improvement.

Role in the DeFi Landscape

Uniswap v2’s role in the DeFi landscape remains substantial due to several key factors.

- Access to Long-Tail Assets: Uniswap v2 continues to provide a platform for trading long-tail assets—tokens that may not be listed on centralized exchanges or newer DEX versions. This inclusivity supports smaller projects and fosters a diverse token ecosystem.

- Educational and Developmental Platform: Uniswap v2 serves as an educational tool for new users entering the DeFi space. Its relatively straightforward interface and functionality make it a suitable starting point for learning about decentralized trading and liquidity provision.

- Resilience and Stability: The established nature of Uniswap v2 means it has undergone extensive testing and use, proving its reliability and stability. This resilience makes it a dependable choice for users seeking a tried-and-true DeFi platform.

- Community and Ecosystem Integration: Uniswap v2 remains deeply integrated into the broader DeFi ecosystem. Many projects and protocols continue to rely on its liquidity pools and trading capabilities, ensuring its continued relevance and utility.

- Complementary Use with v3: Some users prefer the simplicity and cost structure of v2 for specific use cases, while using v3 for others. This complementary use ensures that Uniswap v2 remains active and useful alongside its more advanced successor.

- Historical Significance and Legacy: As a pivotal development in the history of DeFi, Uniswap v2 holds historical significance. Its legacy and proven track record continue to attract users and liquidity providers, maintaining its position as a cornerstone of decentralized finance.