Yes, Uniswap v3 is available and live on the Ethereum blockchain. It offers advanced features like concentrated liquidity, customizable fee tiers, and improved oracle functionality, making it a powerful tool for decentralized trading and liquidity provision. Users can start using it by connecting their Ethereum wallets.

Introduction to Uniswap v3

Overview of Uniswap

Uniswap is a decentralized exchange (DEX) protocol built on the Ethereum blockchain. It allows users to trade Ethereum-based tokens directly from their wallets without the need for intermediaries. By utilizing automated market maker (AMM) technology, Uniswap facilitates trading by using liquidity pools, which are collections of tokens locked in smart contracts. This decentralized approach offers several advantages over traditional exchanges, including:

- Permissionless Trading: Anyone can trade tokens or provide liquidity without needing approval from a central authority.

- Censorship Resistance: Transactions are executed on the Ethereum blockchain, ensuring they cannot be censored or reversed.

- Lower Fees: By eliminating intermediaries, Uniswap can offer lower fees compared to centralized exchanges.

Evolution of the Uniswap Protocol

Since its launch, Uniswap has undergone significant improvements, evolving through various versions to enhance its functionality and user experience. The key milestones in the evolution of Uniswap include:

- Uniswap v1: Launched in November 2018, Uniswap v1 introduced the concept of automated market making and liquidity pools. It laid the foundation for decentralized trading by enabling token swaps directly on the Ethereum blockchain.

- Uniswap v2: Released in May 2020, Uniswap v2 brought several improvements, including support for ERC20/ERC20 token pairs, on-chain price oracles, and flash swaps. These enhancements made the protocol more versatile and efficient, attracting a larger user base.

- Uniswap v3: The latest version, Uniswap v3, launched in May 2021, introduces concentrated liquidity, which allows liquidity providers to allocate their capital within specific price ranges. This innovation significantly increases capital efficiency and provides liquidity providers with greater control over their investments.

Key Features of Uniswap v3

Concentrated Liquidity

Concentrated liquidity is one of the standout features of Uniswap v3, allowing liquidity providers to concentrate their capital within specific price ranges. This enables:

- Increased Capital Efficiency: By focusing liquidity in active trading ranges, providers can achieve higher returns on their capital.

- Enhanced Flexibility: Providers can choose price ranges based on their market expectations, adjusting their positions to maximize profitability.

- Better Price Stability: Concentrated liquidity helps maintain tighter spreads, improving the overall trading experience for users.

Capital Efficiency

Uniswap v3 introduces significant improvements in capital efficiency, making it more attractive for liquidity providers and traders alike. The benefits include:

- Higher Yield Potential: With capital concentrated in specific price ranges, liquidity providers can earn more fees relative to the amount of capital they commit.

- Optimized Liquidity Provision: Providers can allocate their funds more strategically, reducing the need to overcommit capital to achieve meaningful returns.

- Reduced Slippage: The efficient use of capital helps maintain lower slippage rates, benefiting traders with more predictable transaction outcomes.

Customizable Fee Tiers

Uniswap v3 offers customizable fee tiers, giving liquidity providers more control over their earnings and risk management. This feature includes:

- Multiple Fee Options: Providers can select from different fee tiers (e.g., 0.05%, 0.30%, and 1%) based on their risk tolerance and market conditions.

- Risk Management: By choosing appropriate fee tiers, providers can balance the trade-off between earning potential and exposure to volatile price movements.

- Market Segmentation: Different fee tiers allow Uniswap v3 to cater to various market segments, attracting a broader range of participants and enhancing overall liquidity.

How to Use Uniswap v3

Connecting Your Wallet

To start using Uniswap v3, the first step is connecting your Ethereum wallet to the platform. Here’s how you can do it:

- Choose a Compatible Wallet: Uniswap v3 supports various Ethereum wallets such as MetaMask, WalletConnect, Coinbase Wallet, and others.

- Install and Set Up: If you haven’t already, install your chosen wallet and follow the setup instructions to secure your wallet with a strong password and backup phrase.

- Connect to Uniswap: Visit the Uniswap v3 interface and click on the “Connect Wallet” button. Select your wallet from the list, and approve the connection through your wallet’s interface.

Adding Liquidity

Adding liquidity to Uniswap v3 allows you to earn fees from trades that occur within your specified price range. Here’s the process:

- Navigate to the Pool Section: Once your wallet is connected, go to the “Pool” tab on the Uniswap v3 interface.

- Choose a Token Pair: Select the tokens you want to provide as liquidity. Uniswap v3 supports a wide range of Ethereum-based tokens.

- Set Your Price Range: Specify the price range within which you want to provide liquidity. This range will determine where your funds are concentrated and how much fee income you can generate.

- Deposit Tokens: Enter the amount of each token you want to add to the liquidity pool, then approve the transaction in your wallet. Ensure you have enough tokens and ETH for gas fees.

- Confirm the Transaction: Review your inputs and confirm the transaction. Your tokens will be locked in the liquidity pool, and you will start earning fees from trades that occur within your price range.

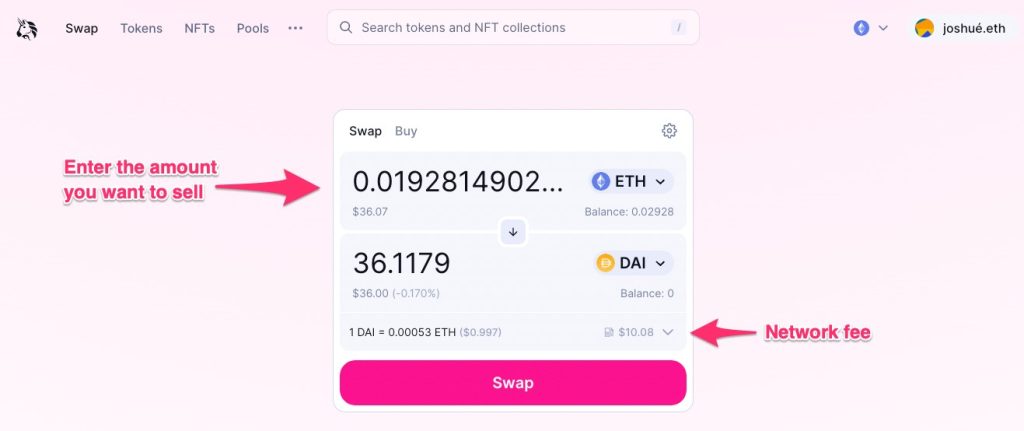

Swapping Tokens

Swapping tokens on Uniswap v3 is straightforward, offering a seamless way to trade Ethereum-based tokens. Here’s how to swap tokens:

- Go to the Swap Section: On the Uniswap v3 interface, click on the “Swap” tab.

- Select Tokens to Swap: Choose the token you want to swap from and the token you want to receive. Ensure that your wallet has enough of the token you want to trade.

- Enter the Amount: Specify the amount of the token you want to swap. The interface will show the estimated amount of the token you will receive.

- Review Transaction Details: Check the details of the transaction, including the swap rate, price impact, and fees.

- Approve the Token: If it’s your first time swapping a particular token, you might need to approve it for trading. This step requires a separate transaction.

- Execute the Swap: Once approved, click on the “Swap” button and confirm the transaction in your wallet. The swap will be processed, and the new tokens will appear in your wallet once the transaction is confirmed on the Ethereum network.

Benefits of Uniswap v3

Reduced Slippage

Uniswap v3 offers reduced slippage, which is a significant advantage for traders. Slippage occurs when the executed price of a trade differs from the expected price, often due to insufficient liquidity. Uniswap v3 mitigates this issue through:

- Concentrated Liquidity: By allowing liquidity providers to concentrate their capital within specific price ranges, Uniswap v3 ensures more liquidity is available at these ranges, reducing the impact of large trades on prices.

- Tighter Spreads: Concentrated liquidity helps maintain tighter bid-ask spreads, which minimizes the price difference between buy and sell orders, leading to more predictable trading outcomes.

Increased Returns

Liquidity providers on Uniswap v3 can experience increased returns compared to previous versions of the protocol. This is achieved through:

- Enhanced Capital Efficiency: Providers can concentrate their liquidity within specific price ranges where trading is most active. This efficient use of capital means providers can earn higher fees with less capital.

- Customizable Fee Tiers: Liquidity providers can choose from multiple fee tiers, allowing them to earn higher fees based on their risk appetite and the volatility of the trading pairs they support.

Flexible Liquidity Provision

Uniswap v3 offers flexible liquidity provision, which is advantageous for both new and experienced liquidity providers. The flexibility includes:

- Custom Price Ranges: Providers can specify the price ranges within which they want to provide liquidity, tailoring their strategies to market conditions and personal risk preferences.

- Dynamic Adjustments: Providers can adjust their positions as market prices fluctuate, moving their liquidity to more active price ranges to maximize earnings.

- Multiple Fee Options: By offering different fee tiers (such as 0.05%, 0.30%, and 1%), Uniswap v3 caters to various market conditions and user preferences, providing greater control over potential returns and risk management.

Differences Between Uniswap v2 and v3

Liquidity Provision Changes

Uniswap v3 introduces significant changes to liquidity provision, enhancing the way liquidity is managed and utilized on the platform:

- Concentrated Liquidity: Unlike Uniswap v2, where liquidity is distributed evenly across the entire price range from 0 to infinity, Uniswap v3 allows liquidity providers to concentrate their funds within specific price ranges. This enables more efficient use of capital and allows providers to earn higher returns.

- Active vs. Passive Liquidity: In v3, liquidity providers can take a more active role by adjusting their price ranges based on market conditions. This contrasts with v2, where liquidity provision was more passive and less dynamic.

- Increased Capital Efficiency: By allowing liquidity to be concentrated in active price ranges, Uniswap v3 significantly improves capital efficiency, enabling more significant returns for liquidity providers with less capital investment.

Fee Structure Enhancements

Uniswap v3 offers enhanced flexibility in fee structures, providing more options for liquidity providers to optimize their earnings based on their risk tolerance and market conditions:

- Multiple Fee Tiers: Uniswap v3 introduces multiple fee tiers (e.g., 0.05%, 0.30%, and 1%) compared to the single fee tier in v2. This allows liquidity providers to choose a fee structure that best matches their risk appetite and the volatility of the trading pair.

- Fee Customization: Providers can select different fee tiers for different price ranges, enabling them to optimize their fee earnings based on market activity and their strategic preferences.

- Enhanced Revenue Potential: The flexibility in fee tiers allows providers to earn more fees from volatile or less liquid pairs, which can be more lucrative under certain market conditions.

Oracle Improvements

Uniswap v3 brings substantial improvements to its price oracle mechanism, enhancing the accuracy and reliability of price data:

- Time-Weighted Average Prices (TWAPs): Uniswap v3 enhances the TWAP mechanism by allowing price oracles to be more robust and less susceptible to manipulation. This is crucial for applications that rely on accurate and reliable price feeds.

- Improved Data Aggregation: The v3 oracles can aggregate price data over different time frames more efficiently, providing more granular and accurate price information.

- Increased Security: With better oracle implementation, Uniswap v3 offers higher security and reliability for DeFi projects that depend on precise price data for their operations, such as lending platforms and derivatives markets.

Security and Audits of Uniswap v3

Security Measures

Uniswap v3 incorporates several security measures to ensure the safety and integrity of the platform:

- Smart Contract Verification: All smart contracts used in Uniswap v3 are thoroughly tested and verified before deployment. This helps to identify and mitigate any potential vulnerabilities.

- Decentralization: The decentralized nature of Uniswap v3 reduces the risk of single points of failure. By spreading control across a wide network, the platform enhances its security and resilience against attacks.

- Continuous Monitoring: Uniswap v3 employs continuous monitoring and automated alerts to detect any unusual activity, allowing for rapid response to potential security threats.

Audit Reports

Uniswap v3 has undergone extensive security audits conducted by reputable firms specializing in blockchain and smart contract security:

- Comprehensive Audits: Multiple independent security firms have reviewed Uniswap v3’s codebase to identify and address vulnerabilities. These audits cover various aspects, including smart contract logic, potential attack vectors, and overall security architecture.

- Public Reports: The audit reports are publicly available, providing transparency and allowing the community to review the findings and understand the measures taken to secure the platform.

- Regular Updates: The Uniswap team continuously updates the platform based on audit recommendations and evolving security best practices, ensuring that the system remains secure against emerging threats.

User Safety Tips

While Uniswap v3 provides a secure trading environment, users should also take proactive steps to enhance their own security:

- Use Reputable Wallets: Always use well-established and reputable wallets to interact with Uniswap v3. Ensure that your wallet is up to date with the latest security features.

- Enable Two-Factor Authentication (2FA): If your wallet or exchange supports 2FA, enable it to add an extra layer of security to your account.

- Be Wary of Phishing Attacks: Always double-check URLs and avoid clicking on suspicious links. Use bookmarks to access Uniswap v3 directly and avoid phishing sites designed to steal your credentials.

- Regularly Update Software: Keep your wallet software, browser, and any related tools updated to protect against the latest security vulnerabilities.

- Monitor Transactions: Regularly monitor your wallet and transaction history for any unauthorized activities. Quickly report and address any suspicious transactions to minimize potential losses.

Conclusion

Summary of Uniswap v3

Uniswap v3 represents a significant evolution in decentralized exchange technology. It introduces several key features that enhance the platform’s functionality and user experience:

- Concentrated Liquidity: Allows liquidity providers to allocate their funds within specific price ranges, improving capital efficiency and potential returns.

- Customizable Fee Tiers: Offers multiple fee options, enabling liquidity providers to optimize their earnings based on market conditions and risk preferences.

- Improved Oracle Functionality: Enhances the accuracy and reliability of price data, providing more robust support for DeFi applications that depend on precise pricing information.

These improvements make Uniswap v3 a powerful tool for both traders and liquidity providers, offering greater flexibility, efficiency, and profitability.

Future Prospects

The future of Uniswap v3 and the broader decentralized finance (DeFi) ecosystem looks promising. Key trends and developments to watch include:

- Layer 2 Integrations: As Ethereum continues to evolve, layer 2 solutions like Optimistic Rollups and zk-Rollups could further reduce transaction costs and increase throughput for Uniswap v3.

- Expansion to Other Blockchains: Uniswap v3 may expand to other blockchain platforms, enhancing its reach and accessibility.

- Increased Adoption: As more users and institutions recognize the benefits of DeFi, Uniswap v3 is likely to see increased adoption and liquidity, further solidifying its position as a leading decentralized exchange.