The current version of Uniswap is V3, which was launched in May 2021.

Overview of Uniswap Versions

History of Uniswap Versions

Uniswap has undergone significant evolution since its inception, with each version introducing new features and improvements:

- Uniswap V1: Launched in November 2018, Uniswap V1 was the first decentralized exchange to use the automated market maker (AMM) model. It allowed users to trade ERC-20 tokens directly from their wallets without relying on traditional order books.

- Uniswap V2: Released in May 2020, Uniswap V2 brought several enhancements, including the ability to trade any ERC-20 token directly against any other ERC-20 token. V2 also introduced features such as price oracles, flash swaps, and improved routing for better trading efficiency.

- Uniswap V3: Launched in May 2021, Uniswap V3 introduced concentrated liquidity, multiple fee tiers, and enhanced capital efficiency. These improvements aimed to provide liquidity providers with greater control and flexibility, while offering traders more competitive pricing.

Key Milestones in Development

Uniswap has achieved several key milestones throughout its development, marking its growth and impact in the decentralized finance (DeFi) space:

- Initial Launch and Growth: The launch of Uniswap V1 marked the beginning of a new era in decentralized trading. Its innovative AMM model quickly gained traction, leading to significant growth in user adoption and trading volume.

- Introduction of V2: The release of Uniswap V2 addressed many limitations of the original version, making the platform more versatile and efficient. The ability to trade any ERC-20 token pair and the addition of price oracles and flash swaps were major milestones that enhanced the platform’s functionality.

- Liquidity Surge and UNI Token Launch: In September 2020, Uniswap launched its governance token, UNI, distributing it to early users and liquidity providers. This event not only rewarded early adopters but also introduced decentralized governance, allowing the community to vote on protocol changes.

- V3 Launch and Concentrated Liquidity: The launch of Uniswap V3 in May 2021 was a major milestone, bringing groundbreaking features like concentrated liquidity and multiple fee tiers. These innovations significantly improved capital efficiency and allowed liquidity providers to earn higher returns.

- Layer 2 Integration: To address high gas fees on the Ethereum network, Uniswap began integrating Layer 2 scaling solutions, such as Optimistic Rollups. This milestone aimed to reduce transaction costs and improve the user experience by enabling faster and cheaper trades.

Introduction to Uniswap V3

Key Features of Uniswap V3

Uniswap V3 introduces several groundbreaking features designed to enhance the platform’s efficiency and user experience:

- Concentrated Liquidity: This feature allows liquidity providers to allocate their funds within specific price ranges, maximizing the use of their capital and potentially earning higher returns. Providers can concentrate their liquidity where they believe most trading will occur, leading to improved capital efficiency.

- Multiple Fee Tiers: Uniswap V3 offers three different fee tiers (0.05%, 0.3%, and 1%) for liquidity providers to choose from. This flexibility allows providers to align their fee structures with the volatility and risk of the trading pairs they support.

- Range Orders: Users can set limit orders within specified price ranges, providing more control over their trading strategies. This feature is similar to traditional limit orders on centralized exchanges.

- Non-Fungible Liquidity Positions: Each liquidity position in Uniswap V3 is represented as a non-fungible token (NFT), allowing for more precise management and transferability of liquidity assets. This gives liquidity providers greater control and flexibility.

- Improved Oracle Functionality: Uniswap V3 enhances the built-in time-weighted average price (TWAP) oracles, making them more efficient and secure for use in other DeFi applications.

Enhancements Over Previous Versions

Uniswap V3 builds upon the successes of its predecessors, introducing several significant improvements:

- Enhanced Capital Efficiency: The concentrated liquidity feature allows for more efficient use of capital compared to Uniswap V2, where liquidity was spread evenly across the price curve. This results in better returns for liquidity providers and more competitive pricing for traders.

- Lower Slippage: By allowing liquidity to be concentrated within narrower price bands, Uniswap V3 reduces slippage for trades. This leads to better execution prices for traders, particularly for large orders.

- Flexible Fee Structures: The introduction of multiple fee tiers provides liquidity providers with more options to optimize their returns based on market conditions and the risk profiles of different trading pairs.

- Advanced Trading Features: The ability to set range orders and manage liquidity positions as NFTs gives users more sophisticated tools for trading and liquidity provision, making Uniswap V3 more versatile and user-friendly.

- Improved Oracle Security: The enhanced oracle functionality in Uniswap V3 offers more secure and reliable price feeds for use in other DeFi applications, reducing the risk of manipulation and increasing the robustness of the ecosystem.

Release Date and Adoption

Launch Date of Uniswap V3

Uniswap V3 was officially launched on May 5, 2021. This release marked a significant milestone in the evolution of decentralized exchanges, introducing innovative features designed to enhance capital efficiency, provide more control to liquidity providers, and improve the overall user experience. The launch was well-received by the DeFi community, attracting widespread attention and setting the stage for rapid adoption and integration.

Adoption Rate and User Growth

Since its launch, Uniswap V3 has seen impressive adoption rates and substantial user growth, driven by its advanced features and improved performance:

- Rapid Adoption: Within weeks of its release, Uniswap V3 quickly gained traction among both liquidity providers and traders. The platform’s innovative features, such as concentrated liquidity and multiple fee tiers, attracted a wide range of users seeking more efficient and flexible trading solutions.

- Liquidity Growth: The introduction of concentrated liquidity allowed liquidity providers to earn higher returns on their capital, resulting in significant growth in the total value locked (TVL) on the platform. Uniswap V3’s liquidity pools rapidly expanded, providing deeper liquidity and reducing slippage for traders.

- Increased Trading Volume: Uniswap V3’s improved efficiency and user-friendly interface contributed to a surge in trading volume. The platform consistently ranks among the top decentralized exchanges by trading volume, reflecting its popularity and widespread use.

- Ecosystem Integration: Uniswap V3 has been integrated into numerous DeFi applications and protocols, further driving its adoption and user growth. Its robust and flexible design makes it a preferred choice for developers and projects seeking to leverage decentralized liquidity.

- Community Support: The strong and active Uniswap community has played a crucial role in promoting the adoption of V3. Through governance proposals, educational initiatives, and community engagement, users have helped to drive awareness and encourage broader participation in the platform.

- Global Reach: Uniswap V3’s user base spans the globe, with significant adoption across various regions. This global reach has been facilitated by the platform’s intuitive design, multilingual support, and extensive documentation.

Key Differences Between Uniswap V2 and V3

Liquidity Management

Uniswap V2 and V3 differ significantly in how they manage liquidity, impacting the efficiency and profitability for liquidity providers.

- Uniswap V2:

- Uniform Distribution: In Uniswap V2, liquidity is distributed uniformly along the entire price curve between 0 and infinity. This means that liquidity is spread out regardless of the actual trading activity, which can lead to inefficiencies and lower returns for liquidity providers.

- Simpler Management: The uniform distribution makes liquidity provision straightforward, as providers do not need to specify price ranges. However, this simplicity comes at the cost of capital efficiency.

- Uniswap V3:

- Concentrated Liquidity: Uniswap V3 introduces the concept of concentrated liquidity, where liquidity providers can allocate their capital within specific price ranges. This allows providers to concentrate their liquidity in the most active trading ranges, maximizing capital efficiency and potential returns.

- Customized Strategies: Liquidity providers in V3 can implement more customized strategies by choosing the price ranges that align with their market expectations. This flexibility can lead to higher earnings, as liquidity is more effectively utilized.

- Non-Fungible Liquidity Positions: Each liquidity position in V3 is represented as a non-fungible token (NFT), allowing for precise management and transferability of positions. This enables providers to sell or transfer their liquidity positions, adding a new layer of flexibility.

Fee Structures

Uniswap V2 and V3 also differ in their fee structures, offering more tailored options in V3 to suit various trading environments.

- Uniswap V2:

- Fixed Fee: Uniswap V2 has a fixed trading fee of 0.3% for all transactions. This fee is distributed among liquidity providers proportional to their share of the pool. While simple and predictable, this single fee tier does not account for the varying risk and volatility of different trading pairs.

- Uniswap V3:

- Multiple Fee Tiers: Uniswap V3 offers multiple fee tiers (0.05%, 0.3%, and 1%) to accommodate different levels of risk and volatility across trading pairs.

- 0.05% Tier: Suitable for stablecoin pairs or highly correlated assets with low volatility, providing lower fees to attract higher trading volumes.

- 0.3% Tier: This tier is similar to the V2 fee and is suitable for most trading pairs, balancing liquidity provider incentives with trader costs.

- 1% Tier: Designed for exotic or highly volatile pairs, offering higher fees to compensate liquidity providers for the increased risk of impermanent loss.

- Multiple Fee Tiers: Uniswap V3 offers multiple fee tiers (0.05%, 0.3%, and 1%) to accommodate different levels of risk and volatility across trading pairs.

User Experience in Uniswap V3

Interface Improvements

Uniswap V3 has made several enhancements to the user interface to improve accessibility and usability for both new and experienced users.

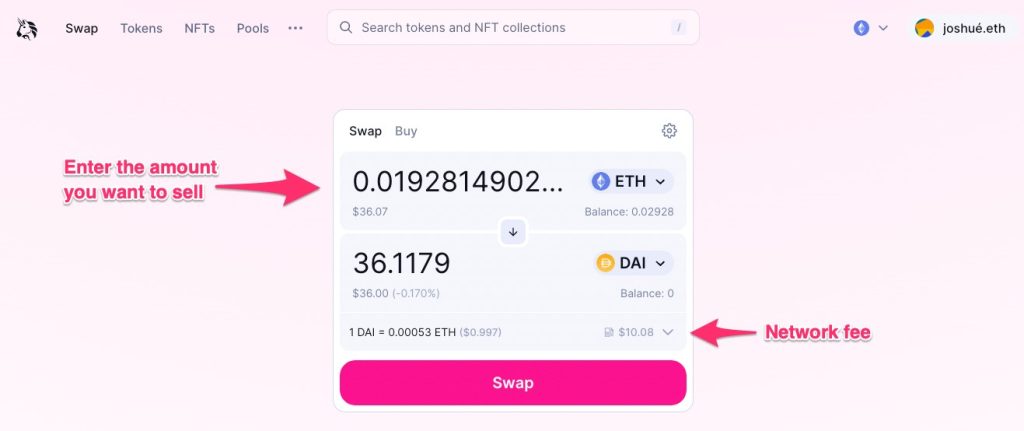

- Streamlined Design: The Uniswap V3 interface features a clean and streamlined design that simplifies navigation and makes it easy to perform various actions, such as swapping tokens and providing liquidity.

- User-Friendly Navigation: Key functions are easily accessible from the main dashboard, allowing users to quickly switch between swapping, pooling, and viewing their portfolio. This intuitive layout reduces the learning curve for new users.

- Enhanced Analytics: Uniswap V3 includes improved analytical tools and visualizations, providing users with detailed insights into trading volumes, price charts, and liquidity pool performance. These tools help users make informed decisions and optimize their strategies.

- Mobile Compatibility: The platform is optimized for mobile use, ensuring a seamless experience across different devices. This is particularly important for users who prefer managing their DeFi activities on the go.

- Tutorials and Help Guides: Uniswap V3 offers comprehensive tutorials and help guides within the interface, assisting users in understanding new features and maximizing the benefits of the platform.

Trading Efficiency

Uniswap V3’s improvements significantly enhance trading efficiency, making it more attractive for traders and liquidity providers alike.

- Concentrated Liquidity: By allowing liquidity providers to concentrate their assets within specific price ranges, Uniswap V3 improves the depth of liquidity at those price points. This reduces slippage and results in better execution prices for traders.

- Lower Slippage: The concentrated liquidity model ensures that there is more liquidity available at the current market price, reducing the impact of large trades on the price and minimizing slippage.

- Faster Transactions: Uniswap V3 benefits from the ongoing developments in the Ethereum ecosystem, such as Layer 2 scaling solutions. These improvements lead to faster transaction processing times and lower gas fees, enhancing the overall trading experience.

- Range Orders: The ability to set range orders allows traders to specify the price ranges at which they are willing to buy or sell tokens. This feature provides more control over trade execution and enables more sophisticated trading strategies.

- Flexible Fee Tiers: Multiple fee tiers in Uniswap V3 allow traders to select pairs with lower fees for less volatile assets, making trading more cost-effective. This flexibility also attracts more liquidity providers, further enhancing market depth and trading efficiency.

- Real-Time Market Data: Uniswap V3 offers real-time market data and price updates, enabling traders to make timely decisions based on the latest market conditions. This feature is crucial for high-frequency trading and active portfolio management.

Security and Audits in Uniswap V3

Security Enhancements

Uniswap V3 has implemented several security enhancements to ensure the safety and integrity of the platform and its users’ assets:

- Comprehensive Smart Contract Audits: Uniswap V3’s smart contracts undergo thorough audits by reputable third-party security firms. These audits are designed to identify and address potential vulnerabilities before deployment.

- Formal Verification: In addition to traditional audits, Uniswap V3 employs formal verification methods to mathematically prove the correctness of its smart contracts. This approach adds an extra layer of security by ensuring the code behaves as intended.

- Improved Oracle Mechanisms: Uniswap V3 has enhanced its price oracle mechanisms, making them more secure and resistant to manipulation. These reliable oracles are crucial for accurate price feeds and reducing the risk of exploitative arbitrage.

- Multi-Signature Wallets: Key operations, such as contract upgrades and fund management, are secured using multi-signature wallets. This requires multiple approvals for significant transactions, minimizing the risk of unauthorized actions.

- Bug Bounty Programs: Uniswap V3 maintains active bug bounty programs to incentivize ethical hackers to identify and report security flaws. This proactive approach helps uncover potential vulnerabilities that might be missed during audits.

- Continuous Monitoring: The platform employs automated tools for continuous monitoring of network activities, detecting suspicious behavior, and potential threats in real-time. This enables prompt responses to any security incidents.

Audit Reports and Findings

Uniswap V3 has been subjected to multiple audits by leading security firms, ensuring its robustness and reliability:

- Audit Firms: Uniswap V3 has been audited by well-known security firms such as ConsenSys Diligence, OpenZeppelin, and Trail of Bits. These firms are recognized for their expertise in blockchain security and smart contract auditing.

- Audit Scope: The audits cover all aspects of Uniswap V3’s smart contracts, including the core functionality, new features like concentrated liquidity, and the implementation of multiple fee tiers. The auditors examine the code for logical errors, security vulnerabilities, and potential exploits.

- Findings and Fixes: The audit reports generally confirm the security and robustness of Uniswap V3’s smart contracts. Any identified issues are promptly addressed and resolved by the development team. The findings and subsequent fixes are usually published in detailed audit reports, ensuring transparency and building user trust.

- Community Reviews: In addition to professional audits, Uniswap V3 benefits from continuous scrutiny by the broader blockchain and DeFi communities. This open-source review process helps to identify and mitigate any remaining vulnerabilities.

Future Updates and Roadmap

Planned Enhancements

Uniswap V3 is continuously evolving, with several planned enhancements aimed at improving functionality, efficiency, and user experience:

- Layer 2 Scaling Solutions: To address high gas fees and network congestion on Ethereum, Uniswap V3 is actively working on integrating Layer 2 scaling solutions such as Optimistic Rollups and zk-Rollups. These solutions will provide faster transactions with significantly lower fees, making the platform more accessible.

- Cross-Chain Compatibility: Uniswap aims to expand its reach by enabling cross-chain compatibility. This will allow users to trade assets across different blockchains seamlessly, enhancing liquidity and accessibility for a broader range of assets.

- Advanced Liquidity Management Tools: Future updates will include more sophisticated tools for liquidity providers to manage their positions. This includes automated strategies, enhanced analytics, and more granular control over liquidity deployment.

- Improved User Interface: Continuous enhancements to the user interface are planned to make the platform more intuitive and user-friendly. This includes better navigation, improved analytics, and more educational resources to help users maximize their experience.

- Enhanced Security Features: Ongoing updates will include the implementation of advanced security protocols and tools to further safeguard user assets and transactions, maintaining Uniswap’s reputation as a secure platform.

- Developer Tools and Integrations: Uniswap plans to release additional developer tools and APIs to facilitate easier integration with other DeFi projects and applications. This will help expand the ecosystem and increase the utility of the Uniswap protocol.

Community Proposals and Governance

Uniswap V3 places a strong emphasis on community governance, allowing users to influence the platform’s direction through proposals and voting:

- UNI Token Governance: Holders of the UNI token have the power to propose and vote on changes to the Uniswap protocol. This decentralized governance model ensures that the community has a direct say in the platform’s development.

- Proposal Process: Any UNI token holder can submit a proposal for changes or improvements to the protocol. Proposals that gain sufficient support move through a series of voting stages before being implemented.

- Transparency and Participation: Uniswap maintains transparency by publicly sharing governance discussions and proposal details. This encourages broader community participation and informed decision-making.

- Funding and Grants: Uniswap allocates funds and grants to support development projects, research, and initiatives that benefit the ecosystem. These grants are often decided through community governance, ensuring that resources are directed towards valuable contributions.

- Continuous Improvement: The community governance model facilitates continuous improvement of the platform. By leveraging the collective expertise and insights of its users, Uniswap can adapt and innovate in response to evolving market needs and technological advancements.