Introduction to Uniswap V3

Overview of Uniswap V3

Uniswap V3 is the latest iteration of the popular decentralized exchange (DEX) on the Ethereum blockchain. It introduces significant improvements over its predecessors, aiming to enhance capital efficiency, provide more control to liquidity providers, and reduce slippage. Key features of Uniswap V3 include:

- Concentrated Liquidity: Allows liquidity providers to allocate their capital within specific price ranges, maximizing the use of their funds and increasing potential returns.

- Multiple Fee Tiers: Offers different fee levels for various types of trading pairs, enabling liquidity providers to select the most appropriate fee structure based on the expected volatility of the asset pair.

- Range Orders: Enables users to set limit orders within specified price ranges, providing more flexibility and control over trading strategies.

- Non-Fungible Liquidity: Each liquidity position is represented as an NFT, allowing for more precise management and transferability of liquidity assets.

These enhancements make Uniswap V3 a powerful tool for decentralized trading and liquidity provision, appealing to both individual traders and institutional investors.

Release Date and Background

Uniswap V3 was officially launched on May 5, 2021, marking a significant milestone in the evolution of decentralized exchanges. The development of V3 was driven by the need to address the limitations of V2, particularly in terms of capital efficiency and flexibility for liquidity providers. The team behind Uniswap, led by founder Hayden Adams, focused on creating a more efficient and user-friendly platform that could cater to the growing demands of the DeFi ecosystem.

Key Features of Uniswap V3

Concentrated Liquidity

Concentrated liquidity is one of the standout features of Uniswap V3, offering liquidity providers (LPs) more control and efficiency. Key aspects include:

- Custom Price Ranges: LPs can allocate their capital to specific price ranges for the tokens they provide. This means they can concentrate their liquidity where they believe most trading will occur, enhancing capital efficiency.

- Increased Earnings Potential: By focusing liquidity within narrower price bands, LPs can earn higher fees compared to the more distributed liquidity in Uniswap V2. This is because their capital is utilized more effectively, resulting in greater returns on investment.

- Reduced Slippage: Concentrated liquidity reduces slippage for traders by ensuring deeper liquidity at specific price points. This leads to more favorable trading outcomes and a better overall trading experience.

- Dynamic Adjustments: LPs can adjust their liquidity positions dynamically as market conditions change. This flexibility allows them to optimize their strategies based on real-time market data.

Range Orders

Range orders in Uniswap V3 introduce a new way for users to manage their trades with greater precision. Key features include:

- Limit Order Functionality: Range orders allow users to specify a price range within which they are willing to trade. This is similar to setting limit orders on traditional exchanges, providing more control over trade execution.

- Automated Execution: When the market price enters the specified range, the trade is automatically executed, reducing the need for constant monitoring and manual intervention.

- Improved Capital Utilization: By setting range orders, users can ensure their capital is deployed only when market conditions meet their criteria, optimizing the use of their funds and reducing idle capital.

- Strategic Flexibility: Traders can employ a variety of strategies using range orders, such as setting buy ranges below the current market price to accumulate assets at lower prices, or sell ranges above the current market price to take profits.

Improvements Over Uniswap V2

Enhanced Capital Efficiency

Uniswap V3 introduces significant enhancements in capital efficiency, addressing some of the limitations present in V2. Key improvements include:

- Concentrated Liquidity: Unlike V2, where liquidity is distributed evenly across the entire price curve, V3 allows liquidity providers to concentrate their capital within specific price ranges. This leads to more effective use of liquidity and higher potential returns for providers.

- Higher Returns: With capital more efficiently deployed within tighter price bands, liquidity providers can achieve greater returns on their investments. The increased precision ensures that liquidity is available where it is most needed, maximizing fee earnings.

- Reduced Slippage: The concentrated liquidity results in deeper pools at specific price points, which reduces slippage for traders. This improvement provides a better trading experience, as trades can be executed closer to the desired price.

- Adaptive Strategies: Liquidity providers can adjust their ranges dynamically in response to market movements, allowing for more strategic and responsive capital allocation. This adaptability helps providers optimize their positions and manage risk more effectively.

Flexible Fee Tiers

Uniswap V3 offers flexible fee tiers to cater to different market conditions and trading pairs, providing more tailored options for liquidity providers and traders. Key features include:

- Multiple Fee Options: V3 introduces three distinct fee tiers: 0.05%, 0.3%, and 1%. Each tier is designed to accommodate different levels of risk and volatility associated with various trading pairs.

- 0.05% Tier: Ideal for stablecoin pairs or highly correlated assets with low volatility, providing lower fees to attract more trading volume.

- 0.3% Tier: Suitable for most trading pairs, balancing between liquidity provider incentives and trader costs. This tier is similar to the standard fee in V2.

- 1% Tier: Designed for exotic or highly volatile pairs, offering higher fees to compensate liquidity providers for the increased risk of impermanent loss.

- Customizable Fee Structures: Liquidity providers can choose the fee tier that best aligns with their risk tolerance and expected trading activity. This flexibility allows for more customized liquidity provisioning strategies.

- Enhanced Market Efficiency: The availability of different fee tiers helps match the right level of liquidity with the appropriate trading activity, improving overall market efficiency and depth.

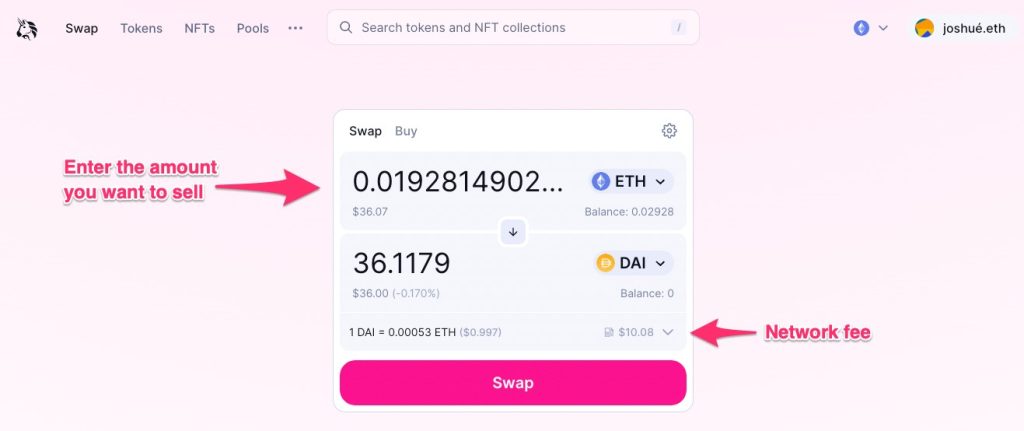

How to Use Uniswap V3

Setting Up a Wallet

To start using Uniswap V3, you need to set up a compatible cryptocurrency wallet. Follow these steps:

- Choose a Wallet: Select a wallet that supports Ethereum and ERC-20 tokens. Popular options include MetaMask, Trust Wallet, and Coinbase Wallet.

- Install the Wallet: Download and install the wallet application on your device. For MetaMask, you can add it as a browser extension or mobile app.

- Create a New Wallet: Open the wallet application and create a new wallet. Follow the on-screen instructions to generate a new wallet address and secure your private keys. Make sure to back up your seed phrase in a safe location.

- Fund Your Wallet: To use Uniswap, you’ll need to fund your wallet with Ethereum (ETH) for transaction fees and any ERC-20 tokens you wish to trade or provide as liquidity. You can purchase ETH on exchanges like Coinbase, Binance, or Kraken, and transfer it to your wallet address.

- Connect to Uniswap: Visit the Uniswap website and click on “Connect Wallet.” Choose your wallet from the list of supported options and follow the prompts to connect securely. Once connected, you can start trading or providing liquidity on the Uniswap platform.

Providing Liquidity

Providing liquidity on Uniswap V3 involves depositing pairs of tokens into liquidity pools. Here’s how to do it:

- Navigate to the Pool Section: After connecting your wallet, go to the “Pool” section on the Uniswap website.

- Add Liquidity: Click on “Add Liquidity” and select the token pair you want to provide liquidity for. You can choose popular pairs or create a new pair if it doesn’t exist yet.

- Set Price Range: Uniswap V3 allows you to set a price range for your liquidity. Specify the minimum and maximum prices within which you want your liquidity to be active. This concentrated liquidity feature helps maximize your capital efficiency.

- Enter Amounts: Enter the amount of each token you wish to deposit. The interface will show the proportionate amounts required based on the current market price and your specified range.

- Approve Tokens: If it’s your first time providing liquidity for a particular token, you’ll need to approve the token transfer. Click “Approve” and confirm the transaction in your wallet.

- Confirm and Deposit: Once the tokens are approved, click “Supply” to deposit them into the liquidity pool. Confirm the transaction in your wallet. Your liquidity position will now be active, and you’ll start earning a share of the trading fees generated within your specified price range.

- Manage Your Position: You can manage and monitor your liquidity positions from the “Pool” section. Adjust your price ranges or withdraw your liquidity at any time based on market conditions and your strategy.

Benefits of Using Uniswap V3

Lower Transaction Costs

Uniswap V3 offers several advantages in terms of reducing transaction costs, making it more accessible and efficient for users. Key benefits include:

- Efficient Gas Usage: Uniswap V3’s concentrated liquidity allows for more efficient use of gas, as trades can be executed within tighter price ranges. This reduces the amount of gas required for each transaction compared to the broader liquidity distribution in V2.

- Optimized Trade Execution: By enabling liquidity providers to concentrate their assets within specific price ranges, Uniswap V3 ensures that trades are executed more efficiently. This results in lower slippage and better prices for traders, indirectly reducing the overall cost of transactions.

- Fee Tiers Matching Volatility: The introduction of multiple fee tiers (0.05%, 0.3%, and 1%) allows liquidity providers to select the most appropriate fee level for their asset pairs, ensuring that transaction costs are aligned with the volatility and risk of the assets being traded. This flexibility helps to minimize unnecessary costs for both traders and liquidity providers.

Increased Earnings for Liquidity Providers

Uniswap V3 significantly enhances the earning potential for liquidity providers through several innovative features. Key benefits include:

- Concentrated Liquidity: By allowing liquidity providers to focus their assets within specific price ranges, Uniswap V3 maximizes the use of capital. This concentration means that providers can earn more fees with less capital, as their liquidity is more effectively utilized where trading activity is highest.

- Flexible Fee Tiers: The multiple fee tiers introduced in V3 enable liquidity providers to choose the fee structure that best suits their risk tolerance and expected trading volume. Higher fee tiers can be selected for more volatile pairs, leading to increased earnings to compensate for the higher risk.

- Active Position Management: Liquidity providers can actively manage their positions, adjusting their price ranges based on market conditions and strategic preferences. This dynamic approach allows providers to optimize their returns and reduce exposure to impermanent loss.

- Non-Fungible Liquidity Positions: Each liquidity position in Uniswap V3 is represented as a non-fungible token (NFT), giving providers more precise control over their liquidity and the ability to transfer or sell their positions. This flexibility enhances the overall earning potential by allowing liquidity providers to react quickly to market changes.

Uniswap V3 Security Measures

Audits and Safety Protocols

Uniswap V3 employs a range of security measures to ensure the safety and integrity of the platform and its users. Key aspects include:

- Comprehensive Smart Contract Audits: Uniswap V3’s smart contracts undergo rigorous audits by reputable third-party security firms. These audits are designed to identify and rectify potential vulnerabilities, ensuring the robustness and security of the platform’s code.

- Formal Verification: In addition to traditional audits, Uniswap V3 utilizes formal verification techniques to mathematically prove the correctness of its smart contracts. This approach further enhances the reliability and security of the platform.

- Bug Bounty Programs: Uniswap offers bug bounty programs to incentivize ethical hackers to identify and report security flaws. These programs encourage the community to participate in the ongoing security assessment of the platform, helping to discover and address potential threats proactively.

- Automated Security Monitoring: Uniswap employs automated tools to continuously monitor the platform for suspicious activities and potential security breaches. This real-time monitoring enables rapid detection and response to any security incidents.

- Multi-Signature Wallets: Key operations on the Uniswap platform, such as contract upgrades and fund management, are secured using multi-signature wallets. This requires multiple approvals for significant transactions, reducing the risk of unauthorized access or malicious actions.

User Best Practices

While Uniswap V3 implements robust security measures, users also play a crucial role in maintaining the security of their assets. Here are some best practices for users:

- Use Reputable Wallets: Always use reputable and well-reviewed wallets, such as MetaMask, Trust Wallet, or Coinbase Wallet. Ensure that your wallet software is up-to-date to benefit from the latest security patches and features.

- Enable Two-Factor Authentication (2FA): Whenever possible, enable 2FA on your wallet and exchange accounts to add an extra layer of security. This helps protect your accounts even if your login credentials are compromised.

- Be Cautious of Phishing Attacks: Be vigilant about phishing attempts. Always double-check URLs and ensure you are accessing the official Uniswap website. Avoid clicking on links from unsolicited emails or messages.

- Secure Your Private Keys and Seed Phrases: Never share your private keys or seed phrases with anyone. Store them in a secure, offline location, and consider using hardware wallets for added security.

- Regularly Monitor Transactions: Keep an eye on your wallet’s transaction history to detect any unauthorized activities promptly. Report any suspicious transactions to your wallet provider and take immediate action to secure your assets.

- Limit Exposure: Only keep the amount of cryptocurrency in your active wallet that you need for immediate transactions. Store the rest in a more secure, offline wallet to minimize exposure to online threats.

- Educate Yourself: Stay informed about the latest security practices and potential threats in the DeFi space. Join community forums and follow reputable sources to keep up-to-date with the latest security recommendations.

Future Developments and Updates

Planned Enhancements

Uniswap V3 continues to evolve with planned enhancements aimed at improving functionality, user experience, and overall efficiency. Key areas of focus include:

- Layer 2 Scaling Solutions: To address high gas fees and network congestion on Ethereum, Uniswap V3 is actively exploring and implementing Layer 2 scaling solutions such as Optimistic Rollups and zk-Rollups. These solutions aim to provide faster transactions with significantly lower fees.

- Cross-Chain Compatibility: Uniswap is working towards expanding its reach by enabling cross-chain compatibility. This will allow users to trade assets across different blockchains seamlessly, enhancing liquidity and accessibility.

- Advanced Liquidity Management Tools: Future updates will include more sophisticated tools for liquidity providers to manage their positions. This includes automated strategies, enhanced analytics, and more granular control over liquidity deployment.

- User Interface Improvements: Continuous enhancements to the user interface are planned to make the platform more intuitive and user-friendly. This includes better navigation, improved analytics, and more educational resources to help users maximize their experience.

- Enhanced Security Features: Ongoing updates will include the implementation of advanced security protocols and tools to further safeguard user assets and transactions, maintaining Uniswap’s reputation as a secure platform.

Community Governance and Proposals

Uniswap V3 places a strong emphasis on community governance, allowing users to influence the platform’s direction through proposals and voting. Key aspects include:

- UNI Token Governance: Holders of the UNI token have the power to propose and vote on changes to the Uniswap protocol. This decentralized governance model ensures that the community has a direct say in the platform’s development.

- Proposal Process: Any UNI token holder can submit a proposal for changes or improvements to the protocol. Proposals that gain sufficient support move through a series of voting stages before being implemented.

- Transparency and Participation: Uniswap maintains transparency by publicly sharing governance discussions and proposal details. This encourages broader community participation and informed decision-making.

- Funding and Grants: Uniswap allocates funds and grants to support development projects, research, and initiatives that benefit the ecosystem. These grants are often decided through community governance, ensuring that resources are directed towards valuable contributions.

- Continuous Improvement: The community governance model facilitates continuous improvement of the platform. By leveraging the collective expertise and insights of its users, Uniswap can adapt and innovate in response to evolving market needs and technological advancements.