Uniswap V3 full range refers to providing liquidity across the entire price range of a trading pair, ensuring constant availability.

Introduction to Uniswap V3

Overview of Uniswap V3

Uniswap V3 is the latest version of the decentralized exchange on the Ethereum blockchain, featuring:

- Concentrated Liquidity: LPs can allocate capital within specific price ranges for increased efficiency.

- Multiple Fee Tiers: Offers 0.05%, 0.30%, and 1.00% fee options to suit different trading pairs and risks.

- Flexible Liquidity Provision: LPs can set custom price ranges for better risk management.

- Enhanced Price Oracles: Provides more accurate on-chain pricing data for dApps.

Key Improvements Over V2

Uniswap V3 offers several enhancements over V2:

- Capital Efficiency:

- Concentrated Liquidity: Higher liquidity and reduced slippage by focusing capital within specific price ranges.

- Custom Price Ranges: Improved flexibility and potential returns for LPs.

- Fee Flexibility:

- Multiple Fee Tiers: Suitable fee structures based on trading pair volatility and risk.

- Improved Oracle Mechanisms:

- Advanced Price Oracles: More accurate and reliable pricing data for DeFi applications.

- Optimized Gas Efficiency:

- Gas Savings: Lower transaction costs for trading and liquidity provision.

Understanding Full Range Liquidity

Definition of Full Range Liquidity

Full range liquidity in Uniswap V3 refers to providing liquidity across the entire possible price range of a trading pair. Unlike concentrated liquidity, where liquidity providers (LPs) specify a narrow price range, full range liquidity means LPs supply liquidity that covers all potential price points from zero to infinity.

Benefits of Full Range Liquidity

Full range liquidity offers several advantages:

- Simplicity: Easier for beginners as it doesn’t require selecting specific price ranges.

- Continuous Trading: Ensures liquidity is available at all times, facilitating uninterrupted trading regardless of price fluctuations.

- Reduced Management: Less need for active management compared to concentrated liquidity, which requires adjusting positions as prices move.

- Stable Fee Earnings: LPs can earn fees from trades occurring at any price point, providing a consistent income stream.

Providing Full Range Liquidity

How to Provide Full Range Liquidity

Providing full range liquidity on Uniswap V3 involves supplying liquidity that spans the entire price range for a trading pair. This approach ensures your liquidity is available at all price points, simplifying the process for liquidity providers (LPs).

Steps to Set Up Full Range Positions

To set up a full range liquidity position on Uniswap V3, follow these steps:

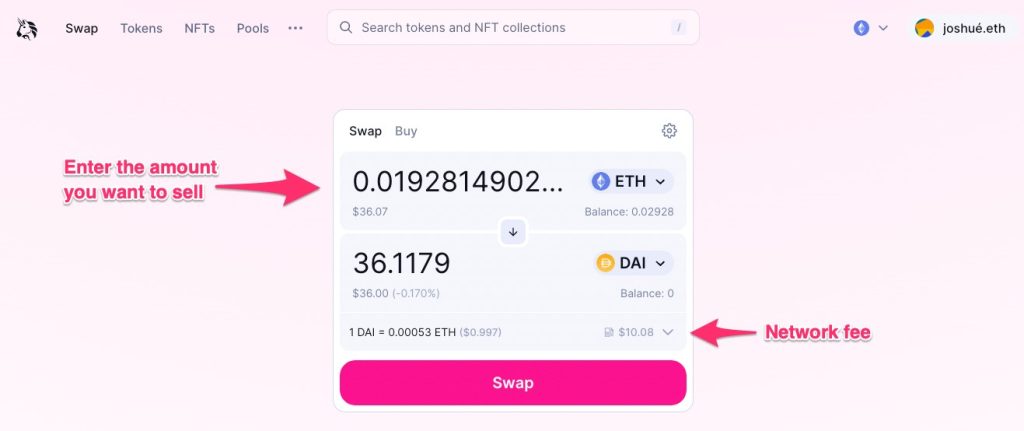

- Connect Your Wallet: Open the Uniswap app or visit Uniswap’s website and connect your Ethereum wallet (e.g., MetaMask, Trust Wallet).

- Navigate to the Pool Section: Click on the “Pool” tab to start providing liquidity.

- Select the Pair: Choose the token pair for which you want to provide liquidity.

- Specify Full Range:

- In the “Price Range” section, set the lower price to the minimum (e.g., 0) and the upper price to the maximum (e.g., infinity). This will cover the entire possible price range.

- Input Amounts: Enter the amounts of each token you wish to deposit into the liquidity pool. The interface will show the required ratio based on the current price.

- Approve Tokens: Approve the use of your tokens if prompted by your wallet.

- Add Liquidity: Review the details and confirm the transaction to add your liquidity to the pool.

- Confirm in Wallet: Complete the transaction by confirming it in your wallet. You may need to approve multiple transactions depending on the tokens you are using.

Risks and Considerations

Impermanent Loss in Full Range

Impermanent loss occurs when the value of the assets you provide to a liquidity pool changes relative to when you deposited them. For full range liquidity, the risks include:

- Higher Exposure: By providing liquidity across the entire price range, you are exposed to all price fluctuations, increasing the potential for impermanent loss.

- Market Volatility: Significant price swings can amplify impermanent loss as the value of one token may diverge considerably from the other.

Managing Risk for Liquidity Providers

To mitigate risks and manage your liquidity provision effectively, consider these strategies:

- Monitor Market Conditions: Keep an eye on market trends and volatility. High volatility periods might require closer monitoring of your liquidity positions.

- Diversify Liquidity: Instead of providing liquidity for a single pair, diversify across multiple pairs to spread risk.

- Adjust Liquidity Ranges: If you become more comfortable with the platform, consider moving to concentrated liquidity, where you can manage smaller, more controlled price ranges.

- Regularly Rebalance: Periodically check and rebalance your liquidity positions to align with market movements and your risk tolerance.

- Utilize Analytics Tools: Use third-party analytics tools to track performance and make informed decisions based on real-time data.

- Stay Updated: Keep informed about Uniswap updates, community discussions, and best practices through official channels and community forums.

Comparison with Concentrated Liquidity

Full Range vs. Concentrated Liquidity

Full Range Liquidity:

- Definition: Provides liquidity across the entire possible price range for a trading pair.

- Advantages:

- Simplicity: Easier to manage as it doesn’t require adjusting positions.

- Continuous Coverage: Ensures liquidity is available at all price points, facilitating uninterrupted trading.

- Disadvantages:

- Capital Efficiency: Less capital efficient compared to concentrated liquidity.

- Higher Impermanent Loss: Greater exposure to price fluctuations can lead to higher impermanent loss.

Concentrated Liquidity:

- Definition: Allows liquidity providers to specify a narrow price range for their liquidity.

- Advantages:

- Capital Efficiency: More capital efficient, as liquidity is concentrated in specific price ranges where trading is most likely to occur.

- Potential for Higher Returns: By concentrating liquidity, LPs can earn higher fees from trades within the specified range.

- Disadvantages:

- Active Management: Requires more active management and adjustment of positions as market prices change.

- Risk of Inactive Liquidity: If the market price moves outside the specified range, the liquidity provided becomes inactive, earning no fees.

Use Cases for Each Liquidity Type

Full Range Liquidity:

- Beginner LPs: Ideal for newcomers to DeFi who prefer a simpler, less hands-on approach.

- Long-Term Holders: Suitable for those looking to provide liquidity passively without frequent adjustments.

- Stable Markets: Works well in stable markets where prices don’t fluctuate widely.

Concentrated Liquidity:

- Experienced LPs: Better suited for experienced liquidity providers who can actively manage and adjust their positions.

- High-Volume Pairs: Ideal for pairs with high trading volumes and frequent price movements, maximizing fee earnings.

- Volatile Markets: Allows LPs to focus their liquidity in price ranges where most trading occurs, even in volatile conditions.

Impact on Traders

How Full Range Liquidity Affects Trading

Full range liquidity has several effects on trading dynamics on Uniswap V3:

- Constant Availability: Ensures that liquidity is always available at any price point, which is crucial for maintaining a seamless trading experience.

- Simplified Trading: Traders can execute trades without worrying about liquidity gaps or the need for frequent price adjustments.

- Lower Risk of Order Failure: With liquidity spread across the entire price range, the risk of trades failing due to insufficient liquidity is minimized.

Slippage and Price Stability

Full range liquidity influences slippage and price stability in the following ways:

- Reduced Slippage: By providing liquidity across all price points, traders experience less slippage, especially in less volatile markets. This is because there is always some liquidity available to accommodate trades, even at extreme price levels.

- Enhanced Price Stability: The continuous presence of liquidity helps to stabilize prices, as large trades are less likely to cause significant price swings. This stability attracts more traders to the platform, increasing overall trading volume.

- Lower Volatility Impact: While full range liquidity helps in stabilizing prices, it might not be as effective in high volatility scenarios compared to concentrated liquidity, which can offer deeper liquidity within specific price bands.

Community and Developer Resources

Official Documentation and Guides

Uniswap provides comprehensive resources to help users and developers understand and utilize the platform effectively:

- Uniswap Documentation:

- Access: Visit the Uniswap Docs.

- Content: Detailed explanations of Uniswap’s architecture, features, and protocol mechanics.

- Guides: Step-by-step instructions for setting up, using, and developing on Uniswap V3.

- API and SDK: Resources for developers to integrate Uniswap’s functionality into their own applications.

- User Guides:

- Getting Started: Tutorials on creating and connecting wallets, executing trades, and providing liquidity.

- Advanced Features: Instructions on using advanced features like concentrated liquidity and custom fee tiers.

Community Forums and Support

For additional help and community interaction, Uniswap offers several forums and support channels:

- Uniswap Community Forum:

- Access: Visit the Uniswap Community Forum.

- Discussions: Participate in discussions about trading strategies, liquidity provision, and protocol upgrades.

- Support: Get help from other Uniswap users and share your experiences.

- Discord Community:

- Join: Access the Uniswap Discord.

- Live Support: Engage in real-time chats with community members and support staff.

- Announcements: Stay updated with the latest news, events, and protocol changes.

- GitHub Repository:

- Access: Visit the Uniswap GitHub.

- Developer Collaboration: Contribute to Uniswap’s codebase, report issues, and collaborate on new features.

- Project Updates: Follow the development progress and access the latest releases.